BLOGS

04 Jun 2025

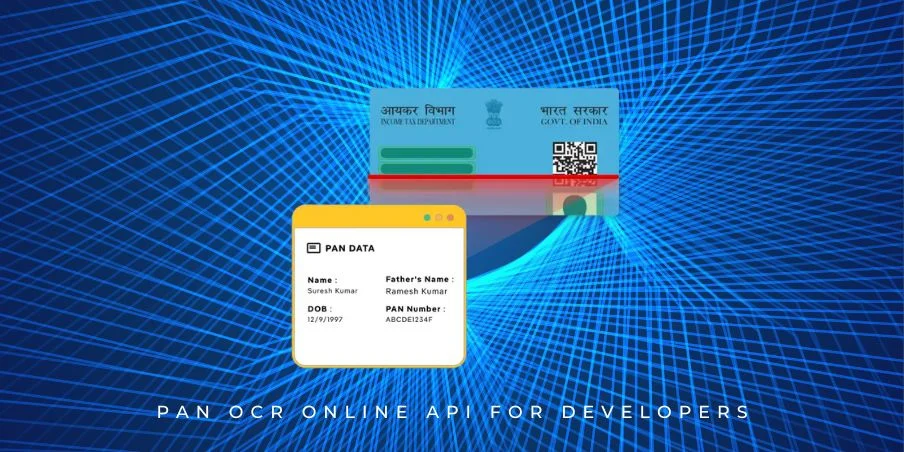

PAN OCR Online API for Developers Unlock Seamless KYC Verification

PAN OCR Online API for Developers is transforming how fintech platforms and onboarding systems handle Know Your Customer (KYC) verification. In the fast-evolving world of digital services, developers often face a complex mix of regulatory requirements, performance expectations, and integration hurdles. One of the most persistent challenges is creating a KYC workflow that is both efficient and compliant. From manual document checks to data mismatches and compliance inconsistencies, the traditional approach is filled with friction. By integrating a PAN OCR Online API for Developers, teams can automate PAN card verification with high accuracy, speed, and reliability—freeing up valuable resources and reducing user drop-offs.

Understanding the Developer’s Dilemma in KYC Automation

When building KYC workflows, developers face significant roadblocks—from managing image uploads in various formats to ensuring that the extracted PAN data aligns with backend validation systems. Often, discrepancies in OCR results due to low image quality or template variations can lead to failed verifications, negatively impacting user onboarding. A robust PAN OCR Online API for Developers helps overcome these issues by offering AI-driven, high-accuracy text recognition tailored specifically for PAN cards.

Another major concern is maintaining compliance while scaling operations. Traditional verification processes can be time-consuming and error-prone, especially when dealing with high volumes of data. With a PAN OCR Online API for Developers, the verification process becomes not only faster but also auditable, making it easier to meet regulatory standards without adding manual overhead.

Ultimately, adopting a purpose-built PAN OCR Online API for Developers allows teams to focus on building core features, rather than spending development cycles on building and maintaining in-house OCR pipelines. This significantly reduces time-to-market, boosts customer onboarding rates, and enhances overall product reliability.

Why PAN OCR is a Game-Changer in Digital Identity Systems

PAN OCR Online API for Developers leverages advanced Optical Character Recognition (OCR) technology to extract structured data—such as the PAN number, name, date of birth, and father’s name—from scanned images or digital photos of PAN cards. By converting unstructured visual information into machine-readable text, developers can seamlessly integrate real-time data extraction into digital KYC workflows, reducing manual intervention and minimizing errors.

The importance of PAN (Permanent Account Number) in India’s compliance ecosystem cannot be overstated. It serves as a key identifier for individuals and entities in various sectors—banking, telecom, fintech, insurance, and investment platforms. Whether it’s opening a bank account, activating a SIM card, or completing a digital loan application, PAN verification is a legal and regulatory necessity. A PAN OCR Online API for Developers ensures that this verification is fast, accurate, and secure, allowing systems to meet stringent compliance standards without slowing down user onboarding.

With rising digital adoption and tighter regulatory oversight, having a reliable PAN OCR Online API for Developers is no longer optional—it’s essential. It empowers developers to build scalable, user-friendly KYC processes while maintaining the trust and compliance required in India’s digital economy.

Comparing Manual vs API-Driven KYC Workflows

Integrating a PAN OCR Online API for Developers can significantly streamline the KYC process compared to traditional manual methods. Below is a side-by-side comparison to highlight the impact in key performance areas:

| Parameter | Manual KYC | API-Driven KYC with PAN OCR Online API for Developers |

| Time per KYC | ~15 minutes | < 5 seconds |

| Accuracy | 85–90% (prone to human error) | 98–99% (AI-enhanced OCR accuracy) |

| Operational Cost | High (requires trained personnel) | Low (automated & scalable) |

| Scalability | Limited (manual bottlenecks) | Highly scalable (parallel processing possible) |

| Compliance Tracking | Manual logs & audits | Automated logs & verifiable data trails |

| User Experience | Slower onboarding | Instant onboarding with real-time verification |

With the PAN OCR Online API for Developers, businesses can reduce KYC turnaround time from minutes to seconds, cut operational costs, and improve user onboarding satisfaction. The shift from manual to API-driven workflows isn’t just a technical upgrade—it’s a strategic advantage.

Architecture of a Modern PAN OCR Online API

At the core of a PAN OCR Online API for Developers is a sophisticated architecture combining machine learning, computer vision, and modern API design principles. This architecture ensures high performance, accuracy, and seamless integration with digital platforms.

1. OCR Engine and Preprocessing

A modern PAN OCR API typically utilizes a hybrid OCR engine architecture:

Traditional OCR: Engines like Tesseract are often used for basic text recognition tasks.

Machine Learning Models: Deep learning models trained specifically on Indian PAN card templates improve accuracy and handle noise, skewed images, and various fonts.

Image Preprocessing: Techniques such as grayscale conversion, adaptive thresholding, and noise reduction are applied to clean and standardize inputs before OCR is run.

These steps drastically enhance the reliability of data extraction, especially in real-world scenarios where image quality can vary.

2. RESTful API Design

A PAN OCR Online API for Developers follows REST principles for ease of use and integration:

HTTP Methods: Primarily POST for uploading images and GET for fetching results.

JSON Responses: Structured outputs in JSON format ensure easy parsing and compatibility with most backend systems. A typical response might look like:

{

“pan_number”: “ABCDE1234F”,

“name”: “RAHUL SHARMA”,

“father_name”: “SURESH SHARMA”,

“dob”: “1990-05-14”

}

3. Webhook Support

Advanced implementations offer webhook callbacks:

- Ideal for asynchronous workflows or large file processing.

- The client system gets notified via a predefined endpoint once processing is complete.

- Reduces polling overhead and improves user experience.

4. Security Layers

Security is paramount, especially when handling sensitive identity documents:

- HTTPS encryption for all data in transit.

- Token-based authentication or API key validation to restrict unauthorized access.

- Rate limiting & throttling to prevent abuse and ensure fair usage.

- Optional data redaction and auto-delete features to meet privacy policies.

A well-designed PAN OCR Online API for Developers not only accelerates KYC workflows but also ensures that the infrastructure is secure, scalable, and easy to integrate—meeting both developer expectations and regulatory requirements.

Real-World Developer Use Cases

Implementing a PAN OCR Online API for Developers delivers measurable impact across industries. Below are three real-world scenarios where this API significantly enhances KYC workflows by reducing time, improving accuracy, and boosting user retention.

1. Startup Fintech Onboarding 1,000+ Users per Day

Challenge: A rapidly growing fintech startup needed to onboard more than 1,000 users daily while maintaining strict KYC compliance and minimizing manual effort.

Solution: By integrating a PAN OCR Online API for Developers, the fintech automated the PAN verification process to complete within seconds.

Results:

- Onboarding time reduced from 15 minutes to less than 10 seconds

- User drop-off rate decreased by 40% due to a seamless KYC experience

- Customer support queries related to KYC dropped significantly

2. Regtech SaaS Automating Multi-Document KYC

Challenge: A regtech SaaS platform aimed to provide KYC automation services for businesses needing to verify multiple documents, including PAN cards, with high accuracy.

Solution: The PAN OCR Online API for Developers was integrated into the platform’s API stack to automate PAN data extraction as part of a larger document verification workflow.

Results:

- Accuracy improved from ~88% to over 99% for PAN field extraction

- Development time reduced due to ready-to-use JSON responses

- Enabled scalable, real-time verification for high-volume clients

3. Legacy Bank Digitizing Offline Verification

Challenge: A traditional bank wanted to modernize its KYC process by replacing manual data entry of scanned PAN cards during in-branch account openings.

Solution: By deploying a secure version of the PAN OCR Online API for Developers, the bank digitized PAN verification without disrupting legacy systems.

Results:

- Manual data entry time cut by 85%

- Customer wait time in branches significantly reduced

- Enhanced compliance through digital logs and automated audit trails

These examples clearly show how the PAN OCR Online API for Developers empowers teams to build faster, smarter, and more compliant KYC solutions while achieving significant operational gains.

Metrics That Matter: Measuring OCR API Success

For developers integrating any document automation tool, especially a PAN OCR Online API for Developers, evaluating performance through precise metrics is critical. These indicators not only reflect technical robustness but also determine the impact on user experience and operational efficiency.

1. Accuracy Rate (%)

The core metric for any OCR system is its ability to extract text with precision. A reliable PAN OCR Online API for Developers should consistently deliver an accuracy rate of 98–99% in ideal lighting and image conditions. Factors such as blurred scans, handwriting, or low resolution can impact performance, so models often include preprocessing steps to mitigate these.

2. Processing Time per Document

Speed directly affects the user journey. Manual PAN verification may take 10–15 minutes, but a well-optimized PAN OCR Online API for Developers should complete the job in under 3 seconds per document. This speed allows for real-time onboarding and seamless integration into fast-moving KYC pipelines.

3. Uptime and SLA Compliance

For production environments, high availability is non-negotiable. Developers should expect the PAN OCR Online API for Developers to offer 99.9% uptime, with Service Level Agreements (SLAs) clearly outlining guarantees for availability, failover, and response times. Any downtime can lead to user drop-offs and compliance issues, especially in regulated industries like banking or insurance.

4. Developer Benchmarks & Expectations

- Latency: API response within 500ms–2s

- Throughput: Handle 50–100 concurrent requests smoothly

- Data Privacy: GDPR and India’s DPDP Act compliance with audit logs

- Error Rate: Below 1% on standard documents

- Scalability: Auto-scale across millions of API calls monthly without lag

When evaluating a PAN OCR Online API for Developers, these metrics form the foundation of what “good” looks like. Developers should monitor them regularly to ensure consistent performance and to justify ROI.

Developer-Focused Integration Strategies

A robust PAN OCR Online API for Developers is only as effective as its ease of integration. Whether you’re building a new fintech app or enhancing a legacy system, seamless integration ensures faster deployment, fewer bugs, and better user experiences.

1. SDKs, Sample Code, and Sandbox Mode

Most production-ready PAN OCR Online API for Developers offer SDKs in major languages such as Python, Node.js, and Java. These SDKs simplify tasks like authentication, request formatting, and response parsing.

Sample code: Ready-to-use examples for uploading images, receiving JSON responses, and handling timeouts.

Sandbox mode: A test environment with simulated PAN documents, allowing developers to verify integration without consuming real API credits.

Postman collections: Pre-configured API calls for testing endpoints without writing code initially.

2. Language-Specific Tips

Python: Use requests or httpx to send multipart/form-data. Handle image preprocessing with Pillow or OpenCV to resize and enhance images before upload.

Node.js: Utilize axios or form-data packages. Implement async error handling and retries for API timeouts.

Java: Use HttpURLConnection or Apache HttpClient. Wrap API calls with exception management and logging for enterprise-scale reliability.

3. Handling Common Error Cases

A good PAN OCR Online API for Developers includes standardized error messages and codes. Here’s how to handle them effectively:

Invalid PAN Format: Validate PAN format (e.g., ABCDE1234F) client-side before API call to save time and cost.

Blurry or Corrupted Images: Implement basic image quality checks (e.g., resolution, file size, brightness) before submission. Provide user feedback like: “Please upload a clearer image of your PAN card.”

Empty or Partial OCR Result: Retry once with basic preprocessing (convert to grayscale, increase contrast). Log failed attempts and alert the user if multiple failures occur.

API Timeout/Server Errors: Always wrap API calls with retries (exponential backoff) and alert systems. Use sandbox mode to simulate failure scenarios during development.

By following these integration strategies, developers can get the most out of a PAN OCR Online API for Developers—ensuring resilience, speed, and accuracy across varied tech stacks.

Security, Compliance, and Trust

When working with sensitive identity information, a PAN OCR Online API for Developers must go beyond performance—it must be built on a foundation of strict security and legal compliance. Handling PAN data responsibly is not just a best practice; it’s a legal mandate under Indian IT laws and global data protection frameworks like the GDPR.

1. Data Handling Regulations

Under the Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011, PAN is classified as sensitive personal data. A PAN OCR Online API for Developers must ensure that:

- Data is collected only for lawful purposes and with user consent.

- PAN data is stored temporarily and deleted after processing unless explicitly required.

- Privacy policies are transparent and accessible to end users.

If the service is offered to global audiences, GDPR principles—such as purpose limitation, data minimization, and user rights (access, deletion, correction)—must also be factored in.

2. Encryption Standards

A secure PAN OCR Online API for Developers must implement TLS 1.2+ encryption for all data in transit. Additionally:

- Uploaded images should be encrypted at rest using AES-256 or equivalent.

- Response payloads containing extracted PAN data should be transmitted securely and optionally masked or redacted.

- Access Control

API access should be managed using:

- API keys or OAuth tokens with scoped permissions.

- Role-based access controls (RBAC) for internal dashboards or admin tools.

- IP whitelisting and rate limiting to prevent abuse or data scraping.

- Audit Logging & Monitoring

To maintain traceability and trust, a PAN OCR Online API for Developers should log:

- Every API call, including client ID, timestamp, and IP address.

- Failures and anomalies (e.g., multiple attempts with invalid images).

- Admin actions such as viewing logs or managing credentials.

These logs should be stored securely and retained for an appropriate audit window, typically 90–180 days.

A developer-centric PAN OCR solution isn’t complete without embedded security and compliance frameworks. Choosing an API that enforces these standards ensures that both developers and users can trust the system—today and as regulations evolve.

Future of PAN OCR and KYC Innovation

The future of identity verification lies in intelligent automation, and a PAN OCR Online API for Developers will continue to evolve as a critical building block in this space. As AI capabilities mature, the potential for more robust, context-aware, and fraud-resistant systems will redefine how developers approach KYC workflows.

1. AI-Driven Enhancements

Modern OCR engines are already powered by machine learning, but upcoming innovations will introduce context-aware extraction—understanding not just characters, but layout, semantics, and document intent. For example, a PAN OCR Online API for Developers will soon be able to distinguish between applicant and co-applicant PAN cards on the same form or auto-validate fields based on standard formats and checksum logic.

Multilingual support is also on the horizon. With India’s diversity of scripts, AI models are being trained to recognize PAN details presented in regional languages (like Hindi or Bengali), significantly improving accessibility and accuracy.

2. From Static Images to Video KYC

Regulators are gradually embracing video-based KYC, which combines live facial verification with document scanning in real-time. A next-gen PAN OCR Online API for Developers could integrate video frame analysis—detecting and extracting PAN data from a live stream, enhancing both fraud detection and onboarding speed.

Combined with liveness checks, this approach can help prevent spoofing, fake documents, or replay attacks—major concerns in digital onboarding.

3. API Interoperability and Ecosystem Growth

KYC is rarely limited to a single document. Developers increasingly need to validate PAN, Aadhaar, GST, and even bank statements in one unified flow. Future-ready PAN OCR Online APIs for Developers will offer modular integration, enabling seamless chaining of APIs such as:

- Aadhaar OCR for address and identity validation.

- GST OCR for business compliance checks.

- Face match APIs to correlate selfie with PAN photo.

Such interoperability reduces integration complexity and enhances user experience, helping developers build cohesive, multi-document KYC systems.

In summary, the evolution of PAN OCR is moving toward smarter, more inclusive, and integrative solutions. For developers, this means less manual effort, greater compliance confidence, and the ability to stay ahead in the rapidly transforming identity verification landscape.

Final Thoughts: Why Every Dev Team Needs This API

In today’s digital-first environment, seamless and secure user onboarding is not a luxury—it’s a necessity. A PAN OCR Online API for Developers isn’t just a tool; it’s a strategic asset that automates identity verification, boosts accuracy, reduces fraud, and accelerates customer acquisition.

1. Speed Up Launch Cycles

Manual KYC processing slows down product rollout and eats into developer time. With a plug-and-play PAN OCR API for Developers, you can launch compliant KYC workflows in days, not weeks—whether you’re building a fintech app, regtech platform, or onboarding engine.

2. Designed for Developers

The API comes with comprehensive documentation, sandbox environments, SDKs for Python, Node.js, and Java, and real-time logs to troubleshoot with ease. Developer support channels and FAQs make integration smooth and hassle-free.

3. Scalable and Cost-Efficient

Whether you’re a startup verifying hundreds of users or an enterprise handling millions, the API’s usage-based pricing and tiered plans offer the flexibility to scale. And with high uptime guarantees, your KYC flow stays reliable—day and night.

The future of digital onboarding is real-time, accurate, and developer-friendly. Start your journey today—try the demo, explore the docs, and integrate the PAN OCR API for Developers into your staging environment.