BLOGS

18 Aug 2025

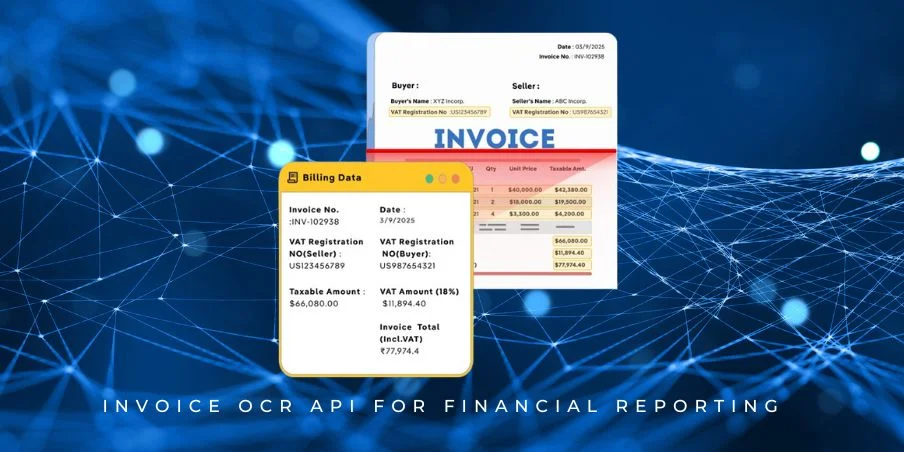

Invoice OCR API for Financial Reporting: Improve Accuracy and Compliance

Invoice OCR API for Financial Reporting is rapidly becoming a foundational tool in the modern financial technology landscape. As businesses evolve to operate in an increasingly data-driven environment, the need for accurate, timely, and automated financial reporting has never been greater. Traditional reporting processes—often dependent on manual data entry and paper-based documents—are not only time-consuming but also error-prone, leading to delays, inaccuracies, and compliance risks.

Invoices, in particular, are more than just payment records; they are rich sources of financial data that directly influence balance sheets, cash flow statements, tax reports, and audit trails. However, extracting structured, report-ready data from hundreds or thousands of invoices remains a major challenge for many finance teams.

This is where Invoice OCR (Optical Character Recognition) APIs step in. These intelligent tools can automatically scan, interpret, and extract key information from invoice documents—such as vendor names, invoice numbers, amounts, tax details, and line items—and convert it into structured formats ready for integration into financial systems. By acting as a bridge between raw invoice data and accurate reporting outputs, Invoice OCR API helps organizations reduce manual workload, improve data accuracy, and ensure regulatory compliance.

As reporting standards tighten and business agility becomes a competitive advantage, companies that adopt automation through technologies like Invoice OCR API for Financial Reporting are better positioned to make faster, more informed decisions while meeting compliance obligations effortlessly.

The Hidden Challenges of Manual Invoice Handling in Financial Reporting

Manual handling of invoices presents significant challenges that can hinder accurate and timely financial reporting. Businesses often receive invoices in a wide variety of formats—including PDFs, scanned images, photos, and emails—making standardization difficult. This fragmentation complicates the extraction of consistent data required for reliable reporting.

Human errors further exacerbate the problem. Typos, overlooked line items, or incorrect tax codes can slip in during manual data entry, leading to inaccuracies that compromise the quality of financial reports. These mistakes not only affect day-to-day accounting but also risk triggering compliance issues during audits.

Additionally, manual processing is inherently slow. Delays in extracting and validating invoice data can push back reporting deadlines, affecting cash flow management and strategic decision-making. Organizations may also find themselves unprepared for audits due to missing or inconsistent data.

To overcome these issues, many are turning to automation solutions such as Invoice OCR API for Financial Reporting, which helps standardize data extraction, reduce errors, and accelerate processing—ultimately supporting more accurate and compliant financial reporting.

What is an Invoice OCR API (and Why It’s a Game-Changer)?

In today’s fast-paced business environment, managing invoices manually is increasingly impractical. This is where an Invoice OCR API for Financial Reporting steps in as a transformative solution. To understand its impact, let’s break down the two core technologies involved: Optical Character Recognition (OCR) and Application Programming Interfaces (APIs).

OCR is a technology that enables computers to recognize and extract text from images or scanned documents. Traditionally, invoices are received in varied formats—such as PDFs, scanned images, or even photos taken on mobile devices—often making it challenging to manually enter data accurately and efficiently. OCR automates this by “reading” the text on these documents, converting it into editable and searchable data.

An API, on the other hand, is a set of protocols that allows different software applications to communicate with each other. When combined, an Invoice OCR API acts as a bridge between raw invoice data and the business’s financial systems. Instead of manually transcribing invoice details, businesses can upload or stream invoice files to the API, which then processes and extracts relevant information.

Specifically, an Invoice OCR API can identify and extract key fields such as vendor names, invoice numbers, invoice dates, tax amounts, payment terms, and detailed line items including product descriptions, quantities, and prices.

The output is delivered in clean, structured formats like JSON or XML, which can be seamlessly integrated into ERP systems, accounting software, or financial reporting tools.

This automation delivers several game-changing benefits. It dramatically reduces the time and labor required for invoice processing, cuts down on human errors such as typos or missing data, and accelerates the entire financial reporting cycle. By implementing an Invoice OCR API for Financial Reporting, companies ensure that invoice data is accurate, consistent, and ready for compliance audits—ultimately improving cash flow management and decision-making.

Moreover, modern OCR APIs often incorporate machine learning, which improves extraction accuracy over time by adapting to different invoice layouts and formats. This means the system becomes smarter and more efficient the longer it is used.

In summary, an Invoice OCR API streamlines the entire invoicing process by converting unstructured, complex invoice documents into clean, structured data, making it an indispensable tool for any finance-driven business aiming for efficiency and accuracy in financial reporting.

Accuracy: From Data Extraction to Financial Integrity

Accuracy is paramount in financial reporting, and one of the greatest advantages of using an Invoice OCR API for Financial Reporting lies in its ability to dramatically reduce human error during data extraction. Manual entry of invoice details—such as vendor names, amounts, tax codes, and line items—is not only time-consuming but also prone to mistakes like typos, missed fields, or misinterpretation of handwritten notes. These errors can cascade downstream, leading to inaccurate reports, compliance issues, and costly audits.

By automating data extraction through an Invoice OCR API, organizations ensure that the initial capture of invoice information is both fast and precise. Advanced OCR engines, often enhanced by machine learning, can recognize complex layouts and extract data fields with high confidence. This automation minimizes common human mistakes and enforces a consistent approach to data capture across large invoice volumes.

Beyond simple extraction, accuracy is reinforced by validating invoice data against internal documents such as purchase orders and contracts.

Matching these records helps detect discrepancies early—ensuring that the invoiced amounts align with agreed terms and preventing overpayments or fraudulent charges. This reconciliation step, powered by API integration with procurement and ERP systems, safeguards financial integrity and improves vendor trust.

In addition, real-time validation of critical data points like tax codes, currency formats, and invoice totals before entering them into accounting systems is essential. An Invoice OCR API can be configured to check that tax calculations comply with regional regulations, currencies are correctly identified and converted if needed, and totals correctly sum line items and taxes. These automated validations help maintain compliance with tax authorities and reduce errors that could trigger audits or penalties.

Overall, implementing an Invoice OCR API for Financial Reporting transforms invoice processing from a high-risk, manual task into a reliable, automated workflow. This not only increases accuracy but also supports financial integrity, compliance, and better decision-making—key factors for any data-driven business.

Compliance: Meeting Regulatory Demands with Confidence

In today’s complex financial landscape, compliance with regulatory standards such as GAAP (Generally Accepted Accounting Principles), IFRS (International Financial Reporting Standards), and tax regulations like VAT or GST is crucial for businesses. Failure to adhere to these requirements can result in costly penalties, legal challenges, and damage to reputation. Ensuring consistent, accurate, and traceable financial records is therefore a top priority.

An Invoice OCR API for Financial Reporting plays a vital role in meeting these compliance demands. By automating the extraction and processing of invoice data, OCR APIs help maintain a consistent and reliable recordkeeping system. Every piece of information—from invoice numbers and dates to tax amounts and payment terms—is captured accurately and stored in structured digital formats, reducing the risks associated with manual data handling.

One key compliance advantage is the ability of OCR APIs to automatically generate and maintain detailed audit trails. These digital logs record each step of the data processing workflow, including when invoices were scanned, which fields were extracted, any validation checks performed, and the integration points with accounting or ERP systems. This traceability is invaluable during both internal audits and external regulatory reviews, providing transparent evidence of data integrity and process controls.

Moreover, automation ensures that compliance-related updates—such as changes in tax rates or reporting standards—can be incorporated into the data extraction and validation rules quickly, keeping financial reporting aligned with current regulations. This reduces the burden on finance teams and minimizes the risk of non-compliance due to outdated procedures.

By leveraging an Invoice OCR API for Financial Reporting, organizations not only streamline their invoice processing but also gain confidence in their ability to meet regulatory requirements efficiently and accurately. This strengthens audit readiness, enhances governance, and supports long-term business sustainability.

Modernizing Financial Reporting Workflows with OCR Integration

In today’s fast-paced business environment, traditional financial reporting workflows often rely heavily on manual data entry, spreadsheet manipulation, and fragmented processes—leading to delays, errors, and limited visibility. Leveraging an Invoice OCR API for Financial Reporting offers a powerful way to modernize and streamline these workflows through automation and seamless integration.

By automating the entire data flow—from invoice receipt to final financial reporting—OCR integration eliminates the need for manual transcription. Once invoices are processed, extracted data such as vendor details, invoice numbers, amounts, taxes, and line items are automatically fed into enterprise resource planning (ERP) systems, business intelligence (BI) tools, and even spreadsheets when necessary. This direct pipeline ensures that financial data remains consistent and up to date across all platforms.

With accurate, real-time data flowing into these systems, organizations can enable dynamic dashboards that provide instant visibility into expenses, liabilities, and cash flow. Monthly and quarterly close processes are also accelerated and simplified, as automated data extraction reduces the bottlenecks traditionally caused by manual invoice processing and reconciliation.

Reducing dependency on manual spreadsheet work not only saves time but also mitigates risks associated with human errors and version control issues. Finance teams can redirect their focus from routine data handling to strategic analysis and decision-making.

Implementing an Invoice OCR API for Financial Reporting thus empowers organizations to build more agile, efficient, and transparent financial workflows—key advantages for staying competitive in a rapidly evolving market.

Case in Point: How a Mid-Sized Enterprise Improved Compliance with Invoice OCR API

A mid-sized enterprise in the manufacturing sector faced significant challenges managing. Its financial reporting due to inconsistent and fragmented invoice records. The company struggled particularly during tax audits. Where missing or inaccurate invoice data led to prolonged review periods, compliance risks, and operational disruptions.

To address these issues, the enterprise implemented an Invoice OCR API for Financial Reporting integrated directly. With their existing ERP system and financial reporting tools. This integration automated the extraction of critical invoice data. Such as vendor details, invoice numbers, dates, tax information, and line-item specifics. Ensuring that all relevant information was captured accurately and stored in a consistent digital format.

The impact was substantial. The company reported an 80% reduction in the time required to process and validate invoices. Freeing up finance staff to focus on higher-value tasks. Extraction accuracy improved to 99%, drastically reducing errors and the need for manual corrections. Most importantly, audit readiness improved dramatically; the organization could produce complete, consistent. And traceable invoice records on demand, enabling a seamless and stress-free tax audit experience.

This case clearly demonstrates how adopting an Invoice OCR API for Financial Reporting not only streamlines invoice processing. But also strengthens compliance and governance. Delivering measurable operational efficiencies and peace of mind.

Choosing the Right Invoice OCR API for Financial Reporting

Selecting the best Invoice OCR API for Financial Reporting is a critical decision that can significantly. Impact the efficiency, accuracy, and compliance of your financial processes. When evaluating options, consider the following key features to ensure you choose a solution that meets your organization’s unique needs:

1. High Extraction Accuracy

Accurate data extraction is foundational. The OCR API should reliably capture all relevant invoice details—including vendor names, invoice numbers, dates, line items, and totals. With minimal errors. Look for solutions that use advanced machine learning models and continuous. Improvement mechanisms to maintain high precision, even with varied invoice formats.

2. Tax Detail Recognition

Invoices often include complex tax information such as VAT, GST, or other regional taxes. An effective Invoice OCR API must accurately recognize and extract these tax details. To support compliant financial reporting and facilitate automated tax calculations and audits.

3. Multi-Format Support

Invoices come in many formats: PDFs, scanned documents, photographs, and digital images. The OCR API should seamlessly process all common formats without loss of accuracy or the need for manual intervention. This versatility ensures the solution can handle your entire invoice volume regardless of source.

4. Integration with ERP and BI Systems

To maximize value, the Invoice OCR API should easily integrate with your existing ERP platforms. Accounting software, and business intelligence tools. Robust API endpoints, webhook support, and compatibility with standard data formats (like JSON or XML) are essential for smooth. Automated data flow across your financial ecosystem.

5. Data Encryption and Compliance Certifications

Handling sensitive financial data demands strong security practices. Choose an Invoice OCR API provider that implements end-to-end data encryption, secure data storage. And adheres to relevant compliance standards such as SOC 2, GDPR, or industry-specific regulations. This ensures your financial data remains protected against breaches and complies with legal requirements.

By prioritizing these features, organizations can confidently adopt an Invoice OCR API for Financial Reporting that enhances accuracy. Efficiency, and regulatory compliance, empowering finance teams to focus on strategic initiatives rather than manual invoice processing.

Pro Tips for Seamless Implementation of Invoice OCR API for Financial Reporting

Implementing an Invoice OCR API for Financial Reporting can significantly enhance your financial operations, but smooth adoption requires thoughtful planning. Here are some expert tips to help you get started efficiently and maximize the benefits:

1. Start with High-Volume Invoice Categories

Focus initial implementation efforts on invoice types that occur most frequently or have the highest processing costs. Such as major suppliers or recurring services. This approach helps quickly realize efficiency gains and provides a manageable scope for initial testing and refinement.

2. Clean Historical Data for Accurate Trend Reporting

Before integrating OCR automation, ensure your existing invoice data is accurate and well-organized. Cleaning and standardizing historical records lays a strong foundation for trend analysis and reporting. Improving the quality of insights drawn from automated data extraction.

3. Use Validation Layers to Enhance Accuracy

Incorporate validation steps such as duplicate invoice detection and purchase order (PO) matching within your OCR workflow. These checks help catch anomalies and prevent errors from propagating into your financial reports, safeguarding data integrity.

4. Train the System with Vendor-Specific Invoice Formats

Different vendors often use unique invoice layouts and terminology. Training your Invoice OCR API with samples from key vendors improves extraction accuracy. By allowing the system to recognize specific patterns, abbreviations, and field placements.

By following these pro tips, organizations can implement an Invoice OCR API for Financial Reporting more seamlessly, reducing disruption while accelerating ROI. The result is a streamlined, accurate, and compliant financial reporting process that supports better business decisions.

Conclusion

Financial reporting demands the highest levels of data accuracy and regulatory compliance to ensure trustworthy insights and sound decision-making. An Invoice OCR API for Financial Reporting goes beyond simple automation. It serves as a critical enabler that transforms raw invoice data into reliable, structured information essential for confident financial management.

By integrating Invoice OCR APIs into your workflows. Your finance team can modernize reporting processes, reduce errors, speed up closing cycles, and maintain strict compliance standards. This technological advancement empowers organizations to respond quickly to changing business needs and regulatory requirements.

FAQs

1. What is an Invoice OCR API and how does it help in financial reporting?

Ans: An Invoice OCR API is a technology that automatically extracts structured data from invoices, such as vendor details, invoice numbers, dates, taxes, and line items. It streamlines financial reporting by reducing manual data entry errors and accelerating data processing. Solutions like AZAPI.ai offer advanced Invoice OCR APIs designed to integrate seamlessly with ERP and accounting systems.

2. How does Invoice OCR improve accuracy in processing bills and invoices?

Ans: Invoice OCR uses machine learning and pattern recognition to extract data with high precision, minimizing human errors common in manual entry. It can also validate fields against existing records to ensure consistency, enhancing financial integrity in reporting.

3. What formats can an Invoice OCR API handle?

Ans: Most Invoice OCR APIs, including those offered by AZAPI.ai, support multiple formats such as PDFs, scanned images, photographs, and even handwritten invoices. This flexibility ensures comprehensive coverage across diverse invoice types.

4. Can a Bill OCR API recognize detailed line items and custom fields?

Ans: Yes, advanced Bill OCR APIs are capable of recognizing complex invoice structures, including line items, quantities, prices, taxes, and custom fields tailored to your business needs. This detailed extraction is crucial for accurate cost tracking and compliance.

5. How secure is the data processed by Invoice OCR APIs?

Ans: Security is a top priority. Leading providers like AZAPI.ai implement end-to-end encryption, comply with regulations such as GDPR and SOC 2, and ensure that sensitive financial data is protected throughout processing and storage.

6. Can Invoice OCR APIs integrate with existing ERP and accounting systems?

Ans: Absolutely. Most modern Invoice OCR APIs offer RESTful APIs and webhook support to easily integrate with popular ERP, accounting, and business intelligence systems, enabling seamless data flow and automation.

7. What are the cost considerations when implementing an Invoice OCR API?

Ans: Pricing typically depends on volume, complexity of invoices, and customization needs. Some providers, including AZAPI.ai, offer scalable pricing models that can reduce per-page costs as volume increases, making it cost-effective for growing businesses.

8. How long does it take to implement an Invoice OCR API?

Ans: Implementation time varies based on the complexity of integration and the level of customization. Starting with high-volume invoice categories and training the system on vendor-specific formats can speed up deployment.

9. How can Invoice OCR APIs help with regulatory compliance?

Ans: By ensuring accurate and consistent data extraction, maintaining digital audit trails, and supporting real-time validation of tax codes and invoice totals, Invoice OCR APIs help organizations meet compliance standards with ease.

10. Why choose AZAPI.ai for Invoice OCR solutions?

Ans: AZAPI.ai offers cutting-edge OCR technology with high accuracy, multi-format support, strong security, and easy integration capabilities. Their expertise in Invoice OCR APIs makes them a trusted partner for businesses seeking to automate and optimize financial reporting.