BLOGS

02 Aug 2025

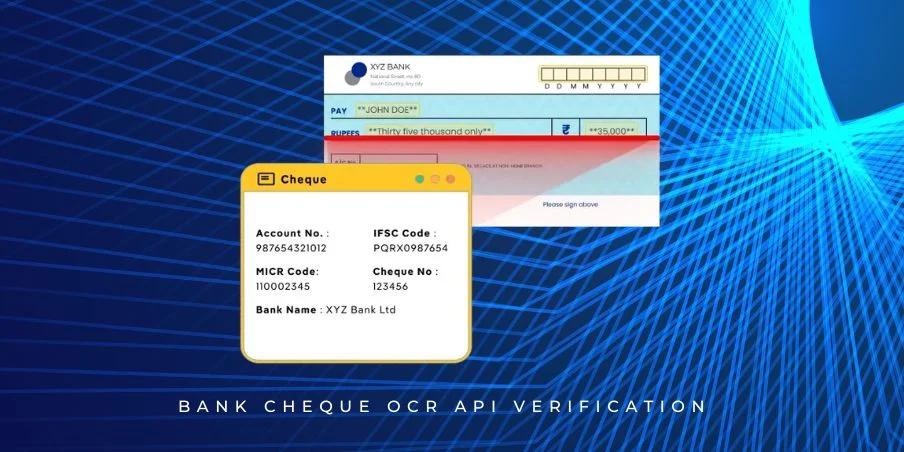

Bank Cheque OCR API Verification for Faster Payment Processing

Bank Cheque OCR API Verification is redefining cheque verification in the digital age by shifting the tedious manual process into a fast, automated workflow that boosts speed and trust in payment processing. Traditional cheque verification involved labor-intensive steps prone to human error and delays, but now fintech platforms are leveraging Bank Cheque OCR API Verification to streamline and secure these critical transactions. How can fintechs leverage this powerful technology to make cheque payments both faster and more secure? This blog explores the transformative role of Bank Cheque OCR in modern payment workflows and why it is becoming indispensable for digital financial services.

The rise of Bank Cheque OCR API addresses long-standing challenges in cheque handling by automating data extraction and validation. With this technology, fintech companies can instantly capture key cheque details like payee information, amount, and account numbers, eliminating manual errors and accelerating clearance times. By integrating Cheque OCR API into payment systems, platforms gain enhanced reliability and compliance, reducing fraud risks while improving customer experience. As cheque payments evolve alongside broader digital transformation, the Bank Cheque OCR API Verification offers a fresh lens through which fintechs can innovate and stay competitive in a fast-paced financial landscape.

The Hidden Bottleneck in Cheque Payments

Traditional cheque payments often face a hidden bottleneck: slow, error-prone verification processes that cause costly delays and expose businesses to fraud risks. Manual cheque verification relies heavily on human reviewers who must painstakingly inspect each cheque, increasing the chances of mistakes and inconsistencies. These bottlenecks not only frustrate customers waiting for clearance but also create operational inefficiencies for businesses managing large volumes of payments. In today’s fast-paced payment ecosystems, speed is essential—not just for customer satisfaction but for maintaining competitive agility.

Bank Cheque OCR API Verification emerges as a powerful solution to these challenges by automating the extraction and validation of cheque data with high accuracy and speed. By digitizing cheque verification, this technology eliminates human error and accelerates processing times, enabling businesses to unlock faster, more reliable payment workflows. Integrating Bank Cheque OCR API Verification helps fintech platforms and payment providers reduce fraud risks while delivering seamless and timely payment experiences for customers and enterprises alike.

How Bank Cheque OCR API Verification Works?

Bank Cheque OCR API Verification works through a streamlined, multi-step process designed to digitize and validate cheque details quickly and accurately. First, the cheque image is captured using high-resolution imaging technology. The OCR engine then performs text recognition, extracting key fields such as the MICR code, cheque number, payee name, amount, date, beneficiary name, IFSC code, bank name, branch details, and signature. This extracted data is parsed and formatted into a structured output.

What makes the Bank Cheque OCR API Verification unique is its real-time data validation capabilities. The extracted information is cross-referenced against bank databases, fraud detection systems, and regulatory watchlists to ensure authenticity and to immediately flag any anomalies. Advanced Artificial Intelligence algorithms empower the system to handle complex cheque formats, including multilingual text and handwritten entries—scenarios where traditional OCR often falls short.

Think of it like a super-smart librarian who instantly scans every book’s details—title, author, ISBN—and verifies them against a master catalog before allowing the book to be checked out. Similarly, the Bank Cheque OCR API Verification ensures that every cheque’s data is accurate and trustworthy within seconds, making payment processing faster, safer, and more reliable.

Why Verification is the Heart of Payment Speed

Verification is the critical step that directly impacts payment clearance timelines in fintech. Traditional cheque processing relies heavily on manual verification, which is time-consuming and prone to errors, causing significant delays. By integrating a Bank Cheque OCR API Verification, fintech platforms can drastically reduce manual intervention. The OCR API automates data extraction and real-time validation, enabling near-instant approvals and faster fund disbursement.

Beyond speeding up payments, using a Bank Cheque OCR API also brings important secondary benefits. It lowers fraud rates by automatically flagging suspicious or altered cheques, reduces chargebacks, and enhances overall customer trust in the platform’s security measures. For example, a fintech startup reported cutting their payment delays by 70% after implementing Bank Cheque OCR API Verification, improving both operational efficiency and user satisfaction.

In essence, verification powered by OCR technology is the heart of payment speed, driving faster, safer, and more reliable cheque processing in the modern fintech landscape.

Standout Capabilities of a Verification-Focused OCR API

A Bank Cheque OCR API Verification offers several standout capabilities that make it indispensable for fintech payment automation. Dynamic error detection allows the system to spot discrepancies in cheque data, such as mismatched dates, amounts, or payee details, reducing costly processing errors. Fraud prevention is another key feature, as the API cross-verifies extracted data against anti-fraud systems and regulatory watchlists to flag suspicious or tampered cheques in real time.

The API also supports multi-format cheque processing, accommodating diverse cheque layouts issued by different banks or across various regions, ensuring broad applicability. Real-time feedback is provided instantly after scanning, enabling seamless and efficient workflow integration that accelerates payment clearance. Lastly, comprehensive audit trails log every verification step, supporting compliance, transparency, and easy dispute resolution.

Together, these features empower fintech platforms to leverage Bank Cheque OCR API Verification for faster, safer, and more reliable cheque payment processing.

Integrating OCR Verification for Maximum Impact

Integrating a Bank Cheque OCR API Verification into fintech systems can go beyond traditional monolithic approaches. Leveraging microservices or event-driven architectures allows seamless adoption, where the OCR verification API acts as an independent service triggered by payment events. This decoupled setup improves scalability, fault tolerance, and easier maintenance.

For enhanced security and auditability, pairing the OCR API with blockchain or distributed ledger technology (DLT) creates tamper-proof verification records. Each verified cheque’s data can be immutably logged on a blockchain, ensuring transparency and compliance while preventing data manipulation.

Fintechs with lean teams can accelerate adoption using low-code or no-code platforms that support API integrations out-of-the-box, enabling rapid deployment without deep engineering overhead.

Overcoming Unconventional Challenges

Integrating a Bank Cheque OCR API Verification isn’t without unique hurdles. One major niche challenge is handling low-quality cheque images—blurred scans, poor lighting, or folded corners can impair text recognition. Similarly, non-standard fonts or handwritten notes on cheques pose difficulties for traditional OCR. Advanced AI-driven OCR models incorporated in the API help overcome these by learning diverse handwriting styles and font variations, improving recognition accuracy even in tricky cases.

Balancing speed with accuracy is critical in high-stakes payment scenarios. While fintechs need near-instant processing to keep users happy, ensuring zero tolerance for errors or fraud is paramount. The Bank Cheque OCR API tackles this by combining rapid automated checks with fallback options for manual review when confidence scores fall below thresholds, maintaining both efficiency and trust.

Ethical considerations also come into play. It’s essential that the AI models behind the OCR verification remain unbiased—trained on diverse cheque samples from various regions and demographics—to avoid systemic errors or unfair rejections. Transparency in model training and continuous monitoring help fintechs uphold fairness in their payment processing.

To optimize API performance in real-world conditions, fintechs should conduct extensive testing with a wide variety of cheque samples, including low-resolution and non-standard cases. Load testing helps assess scalability during peak transaction times. Collecting user feedback on verification accuracy and integrating adaptive learning loops can further refine performance.

By anticipating and addressing these unconventional challenges. Fintechs can harness the full power of Bank Cheque OCR API Verification to deliver fast, accurate, and ethical payment automation.

The Future of Cheque Verification in Fintech

The future of Bank Cheque OCR API Verification is poised for transformative evolution. Driven by advancements in generative AI and predictive analytics. These cutting-edge technologies will enable OCR systems to not only extract and verify cheque data with greater precision. But also predict potential fraud patterns or anomalies before they occur, adding a proactive layer of security to payment processing. Generative AI could assist in reconstructing damaged or partially illegible cheques, vastly improving acceptance rates and reducing manual interventions.

Beyond fintech, the capabilities of OCR verification APIs will expand into cross-industry applications. For example, insurance companies could use similar OCR verification. To automate claims processing by extracting and validating policy documents. While legal tech platforms might leverage the technology for contract validation and compliance checks. This broad applicability underscores the growing importance of OCR-driven automation in various data-intensive fields.

Digital wallets and hybrid payment models are another frontier where Bank Cheque OCR API Verification will play a key role. As digital wallets increasingly support multi-modal payments—including cheque deposits—integrated OCR verification will ensure seamless. Secure, and instant clearance of cheque payments within these platforms, bridging traditional and digital finance effortlessly.

Ultimately, the vision is a world where cheque payments are as fast, secure, and reliable as any purely digital transaction. Driven by intelligent, adaptive OCR verification APIs embedded across fintech and beyond. This evolution will redefine trust and speed in financial ecosystems globally.

Verification as a Competitive Edge

In today’s high-velocity financial landscape, Bank Cheque OCR API Verification is not just a backend upgrade—it’s a strategic differentiator. By redefining how cheques are processed, verified, and cleared. This technology helps fintechs dramatically cut down transaction times while maintaining rigorous standards for accuracy and compliance.

The ability to instantly validate cheque details. Such as amount, account number, and MICR code—ensures that payments flow without the friction of manual review. Significantly enhancing user experience. In a market where every second and every interaction matters. This edge in speed and reliability can set a fintech platform apart. Trust is another key area where OCR verification shines: by detecting fraud, ensuring data consistency, and complying with regulations. It strengthens the credibility of any payment workflow.

Forward-thinking fintechs already recognize that verification speed is central to customer satisfaction and operational efficiency. Adopting Bank Cheque OCR API Verification empowers these businesses to deliver seamless, trustworthy transactions in a fraction of the time.

Call to Action: If you’re building or optimizing a payment product, now is the time to integrate OCR verification. Experiment with APIs, join a beta program, or request sandbox access to see the impact firsthand. Stay ahead—because in fintech, verification isn’t just necessary; it’s a competitive advantage.

Conclusion

The future of cheque processing in fintech lies in automation. And Bank Cheque OCR API Verification is at the heart of this transformation. By shifting from manual verification to intelligent, real-time OCR solutions, fintech platforms can unlock faster payment clearances. Reduce fraud, and elevate customer trust.

Whether you’re building a neobank, a payment gateway, or a lending app. Integrating a Bank Cheque OCR API enhances operational speed, accuracy, and security. With rising demand for seamless financial experiences, adopting OCR technology isn’t optional—it’s strategic.

Ready to take the next step? Start experimenting with Bank Cheque OCR APIs today and lead the charge in payment innovation.

FAQs

1. What is a Bank Cheque OCR API?

Ans: A Bank Cheque OCR API is an application programming interface that uses Optical Character Recognition (OCR) to extract structured data from cheque images. It automatically identifies and reads details such as cheque number, amount, date, payee name, MICR code, IFSC, and more—allowing digital systems to process payments without manual data entry.

2. How does Bank Cheque OCR API Verification work?

Ans: Bank Cheque OCR API Verification involves scanning a cheque image, recognizing printed or handwritten text, and validating key fields against banking systems and fraud detection databases. This ensures both the authenticity and integrity of the cheque before payment approval.

3. What are the key benefits of using a Bank Cheque OCR API for Payments?

Ans:

- Faster payment processing and clearance

- Reduced fraud risk through real-time data verification

- Improved accuracy in data capture

- Lower operational costs by minimizing manual reviews

- Scalability for enterprise-level cheque volumes

4. Can the Bank Cheque OCR API handle handwritten cheques?

Ans: Yes, many modern Bank Cheque OCR APIs use AI and machine learning to handle both printed and handwritten cheque fields. However, the accuracy may depend on the handwriting quality and image resolution.

5. Is Bank Cheque OCR API Verification secure and compliant?

Ans: Absolutely. Leading OCR APIs comply with financial data regulations such as PCI DSS, GDPR, and RBI guidelines. Data encryption, audit logs, and secure endpoints ensure your cheque data is processed safely.

6. How accurate is the Bank Cheque OCR API?

Ans: Accuracy depends on the quality of the image and complexity of the cheque, but top providers offer up to 99.94% accuracy, including support for multilingual fields and variable formats.

7. What platforms can integrate a Bank Cheque OCR API?

Ans: These APIs are typically REST-based and compatible with fintech stacks using Python, Node.js, Java, .NET, and more. They can be used in mobile apps, web apps, or backend systems via SDKs or cloud services.

8. Can small fintech startups afford to use Bank Cheque OCR APIs?

Ans: Yes. Many providers offer scalable pricing, sandbox access, or freemium tiers to support early-stage fintechs. With a Bank Cheque OCR API for Payments, even lean teams can automate cheque verification efficiently.

9. How is Bank Cheque OCR different from generic OCR solutions?

Ans: Bank Cheque OCR is specialized to extract structured financial fields relevant to cheque processing, including MICR codes, IFSC, and payee info. Generic OCR might not recognize such banking-specific formats with the same accuracy or context.

10. Where can I try a demo of Bank Cheque OCR API Verification?

Ans: AZAPI.ai offers demo dashboards or trial API keys. You can request sandbox access to test how Bank Cheque OCR API Verification performs with your specific cheque formats and workflows.