BLOGS

10 Sep 2025

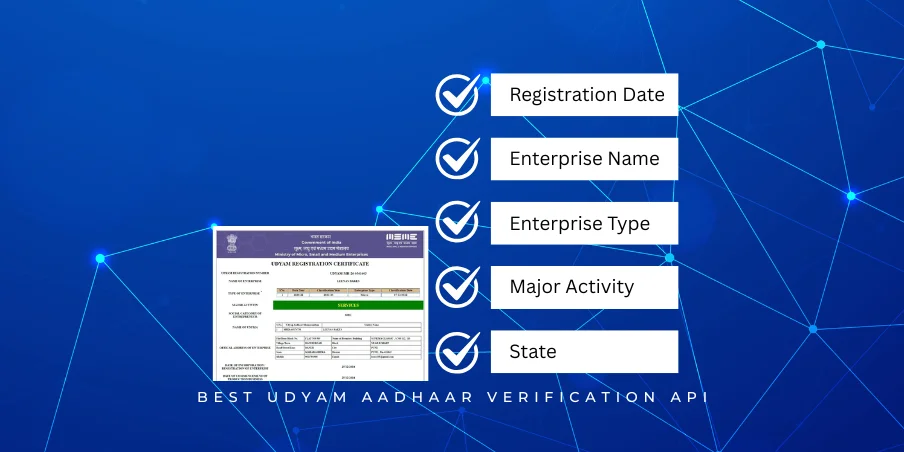

Best Udyam Aadhaar Verification API – Verify MSME Registration

In today’s fast-paced business environment, verifying the credentials of small and medium enterprises is crucial for maintaining trust and compliance. The Best Udyam Aadhaar Verification API stands out as a reliable and efficient solution to authenticate MSME registrations seamlessly. Whether you’re onboarding new partners, extending credit, or verifying vendor authenticity, this API empowers businesses to conduct instant and accurate verification using Aadhaar-linked Udyam registration data.

What is Udyam Aadhaar Verification?

Udyam Aadhaar Verification is a process that allows businesses to validate the registration of Micro, Small, and Medium Enterprises (MSMEs) using government-issued documentation. The Udyam portal, managed by the Ministry of MSME, offers registration details that include essential business credentials such as registration number, Aadhaar linkage, type of enterprise, and operational status.

The Best Udyam Aadhaar Verification API integrates this data into your systems, allowing for real-time verification without the need for manual paperwork or cumbersome processes. By leveraging Aadhaar-linked details, you ensure accuracy, prevent fraud, and streamline verification procedures.

Why Choose the Best Udyam Aadhaar Verification API?

Fast and Accurate Verification

Speed and precision are vital when verifying MSME registration. This API delivers near-instant results by connecting directly with government databases. Users can authenticate businesses by simply providing Aadhaar or registration details, cutting down verification time from days to seconds.

Enhanced Security and Compliance

The API operates within stringent data protection protocols, ensuring secure communication with government portals. With encryption and compliance measures in place, it safeguards sensitive information, helping businesses stay aligned with regulatory frameworks.

Seamless Integration with Existing Systems

Designed for developers and enterprises, the API offers extensive documentation and support for integration into various platforms. Whether you operate in finance, lending, insurance, or supply chain management, you can easily embed verification processes within your workflows.

Fraud Prevention and Risk Mitigation

Fake registrations and misrepresented businesses pose significant risks. Using Aadhaar-linked verification drastically reduces the chances of onboarding fraudulent entities. This, in turn, lowers operational risks and builds confidence among stakeholders.

Key Features of the Best Udyam Aadhaar Verification API

Aadhaar-Based Authentication

By utilizing Aadhaar information, the API provides a high level of authentication accuracy. This feature ensures that the business being verified is genuinely registered under the MSME framework.

Real-Time Data Access

With access to live government records, users receive updated information about a business’s registration status, category, and compliance standing instantly.

Detailed Reports

The API not only confirms registration but also provides additional data points such as industry type, registered address, and date of incorporation. These insights can be used for deeper due diligence.

Bulk Verification Support

For enterprises dealing with multiple vendors or customers, the API supports bulk verification requests, saving time and effort while improving operational efficiency.

User-Friendly Interface and Documentation

The API is designed with developers in mind, offering comprehensive guides, SDKs, and sample codes for various programming environments. This makes implementation simple and error-free.

How Does Udyam Aadhaar Verification Work?

Input Credentials – Enter the Aadhaar-linked Udyam number or other identifiers into your application.

API Request – The request is securely transmitted to the government’s Udyam registry.

Data Retrieval – The registry validates the details and sends back structured data regarding the MSME’s registration.

Report Generation – The API processes the information and delivers a user-friendly report.

Decision Making – Based on the verification report, businesses can approve, flag, or further investigate the entity.

Who Can Benefit from the Best Udyam Aadhaar Verification API?

Financial Institutions and Lenders

Banks, NBFCs, and fintech companies can streamline loan disbursements by verifying borrower credentials instantly. This reduces processing time and enhances trust.

Insurance Providers

Insurance companies can quickly validate the existence of MSMEs, helping them tailor policies and avoid fraudulent claims.

E-Commerce and Marketplaces

Online platforms can authenticate sellers, ensuring they are registered businesses and compliant with government regulations.

Supply Chain and Procurement

Enterprises managing vendor networks can perform thorough due diligence by verifying suppliers’ registration data in real time.

Government and Regulatory Bodies

Government departments can ensure compliance and eligibility verification for various schemes and incentives offered to MSMEs.

How to Integrate the Best Udyam Aadhaar Verification API?

Sign Up and Get API Keys – Register on the provider’s platform to access API credentials.

Review Documentation – Go through the setup guides and supported request formats.

Test in Sandbox Mode – Validate your integration without affecting live data.

Deploy Secure Connections – Ensure HTTPS endpoints and encrypted transmissions.

Monitor and Scale – Use built-in analytics to track verification requests and manage usage limits.

Common Use Cases

- Verifying a startup’s MSME registration before issuing loans.

- Cross-checking vendors during onboarding for supply chain audits.

- Authenticating SMEs applying for government subsidy programs.

- Checking compliance for insurance underwriting.

- Ensuring that freelancers and contractors meet eligibility norms for enterprise projects.

Benefits of Using Aadhaar-Linked Verification

Reduced Manual Errors

By automating data retrieval, the API eliminates human error associated with document review and manual entry.

Time and Cost Savings

Automation reduces operational costs and accelerates workflows, allowing teams to focus on strategic decisions rather than paperwork.

Trustworthy Data Source

Direct integration with government records ensures data reliability, helping businesses make informed decisions based on validated information.

Regulatory Compliance

Verification aligned with official records helps enterprises meet legal requirements, reducing the chances of penalties or audits.

Challenges Addressed by the API

Identity Fraud

The API’s Aadhaar authentication mechanism drastically lowers fraud risks by ensuring that only registered entities are approved.

Inefficiencies in Verification

Manual verification is prone to delays and inaccuracies. Automating the process leads to better decision-making and faster service delivery.

Scalability Issues

Enterprises often struggle to handle growing verification demands. The API’s bulk processing feature allows scaling without affecting performance.

Common Challenges in Udyam Aadhaar Verification and Solutions – How the Best Udyam Aadhaar Verification API Can Help

In today’s business environment, verifying MSME credentials through Udyam Aadhaar is more critical than ever. However, enterprises often face several hurdles while attempting to validate registration details. These challenges range from data inconsistencies to compliance issues, creating bottlenecks in onboarding and verification processes. Fortunately, the Best Udyam Verification API offers robust solutions that address these problems effectively, making it an indispensable tool for businesses aiming to ensure trust, efficiency, and regulatory compliance.

Understanding Udyam Aadhaar Verification

Udyam Aadhaar is the official registration framework for Micro, Small, and Medium Enterprises (MSMEs) in India. It helps businesses access government schemes, subsidies, and loans while offering transparency to partners, customers, and regulatory bodies. Verifying this registration, however, isn’t always straightforward due to outdated records, inconsistent data formats, and the complexity of Aadhaar-linked authentication.

The Best Udyam Aadhaar Verification API simplifies this process by providing instant, accurate, and secure verification services. Before exploring how it solves common issues, let’s look at the challenges that many organizations encounter.

Common Challenges in Udyam Aadhaar Verification

1. Data Inconsistencies and Errors

One of the biggest problems is mismatched or outdated information. For instance, a business’s registered address or category might not reflect recent updates, leading to failed or incorrect verification attempts.

Solution:

The Best Udyam Aadhaar Verification API pulls data directly from government databases in real time, ensuring that only the most current and verified information is used during the verification process.

2. Identity Fraud and Fake Registrations

Fraudulent entities sometimes attempt to register under fake credentials to avail loans, subsidies, or other benefits illegally. This poses a risk to banks, lenders, and business partnerships.

Solution:

With Aadhaar-based authentication, the API cross-verifies submitted details against government records. This reduces fraudulent registrations and helps businesses onboard only genuine entities.

3. Manual Verification Delays

Traditional verification processes often rely on manual document reviews, which are time-consuming and prone to human error. This slows down onboarding and impacts customer experience.

Solution:

The Best Udyam Aadhaar Verification API automates verification, delivering instant responses without manual intervention. This boosts efficiency and accelerates service delivery.

4. Lack of Integration with Business Systems

Many companies struggle to integrate verification processes into their existing workflows. This results in disconnected systems, redundancies, and delays.

Solution:

The API is built with developers in mind. It offers extensive documentation, SDKs, and easy integration options, allowing businesses to embed verification directly into their platforms with minimal effort.

5. Regulatory Compliance Risks

Incorrect verification or missing documentation can lead to penalties or audits from regulatory bodies, causing reputational and financial harm.

Solution:

By ensuring that all data is verified against official government records, the API helps businesses maintain compliance with government regulations and reduces the risk of non-conformance.

6. Scalability Challenges

As businesses grow, handling verification requests at scale becomes difficult. Many organizations experience bottlenecks during peak operations.

Solution:

The Best Udyam Aadhaar Verification API supports bulk verification requests, allowing enterprises to process thousands of records efficiently without affecting performance or accuracy.

7. Security and Data Privacy Concerns

Handling sensitive Aadhaar data requires robust encryption and strict adherence to privacy regulations. Failure to protect this data can result in breaches and legal consequences.

Solution:

The API employs industry-standard encryption protocols and ensures secure data transmission. It is designed to meet compliance requirements, giving businesses peace of mind while handling sensitive information.

How the Best Udyam Aadhaar Verification API Tackles These Challenges

Real-Time Access to Government Records

Instead of relying on outdated spreadsheets or static databases, the API directly connects to Udyam’s government portal, providing accurate and verified data at the time of request.

Aadhaar-Linked Authentication

By using Aadhaar as a primary authentication source, the API ensures that the identity of the MSME is genuine. This significantly reduces fraud and false claims.

Developer-Friendly Integration

The API’s comprehensive documentation, error handling guidelines, and sandbox environment make it easy for businesses to integrate verification services into existing systems.

Automated Verification Workflows

Automation eliminates repetitive manual tasks, reduces human error, and ensures faster decision-making — critical for industries like banking, insurance, and e-commerce.

Compliance and Risk Management

With built-in validation checks and government-standard encryption, the API helps businesses maintain compliance and protect data without investing heavily in additional security infrastructure.

Bulk Processing Capabilities

Enterprises can handle large volumes of verification requests efficiently, helping them scale operations without compromising on speed or accuracy.

Real-Life Use Cases

Financial Services: Banks and NBFCs can automate borrower verification, reducing loan processing times while ensuring regulatory compliance.

Insurance Providers: Fast verification helps insurance companies assess risk and prevent fraudulent claims without delays.

E-Commerce Platforms: Marketplaces can onboard sellers quickly, ensuring that all vendors are legitimate businesses.

Government Programs: Agencies can streamline subsidy and grant disbursal by authenticating MSMEs in real time.

The challenges in Udyam Aadhaar verification can hinder growth, increase risks, and complicate compliance for businesses. However, the Best Udyam Aadhaar Verification API offers an effective, secure, and scalable solution. By leveraging real-time government data, Aadhaar authentication, and automation, it transforms the verification process into a seamless, reliable, and efficient operation.

For organizations looking to overcome verification hurdles and enhance trust in their business operations, adopting this API is not just a solution — it’s a competitive advantage. Ensure your enterprise stays ahead by integrating the Best Udyam Aadhaar Verification API into your systems today.

RPACPC: Choosing the Right Udyam Aadhaar Verification API for Your MSME Needs

In the fast-evolving world of small and medium enterprises (MSMEs), accurate and timely verification of business credentials is essential. Whether you’re seeking government benefits, loans, or establishing partnerships, ensuring that an enterprise’s registration is valid and trustworthy is critical. RPACPC understands these challenges and recommends using the Best Udyam Aadhaar Verification API to streamline MSME verification while enhancing efficiency, security, and compliance.

Selecting the right API can make a significant difference in how businesses authenticate MSME registrations. This article explores how to choose the best solution for your enterprise’s verification needs, what features to look for, and why the Best Udyam Aadhaar Verification API stands out as the ideal choice.

Why Udyam Aadhaar Verification is Crucial for MSMEs

Udyam Aadhaar registration, governed by the Ministry of MSME, serves as the official identity for businesses under the MSME category. Verification of this registration helps ensure that enterprises are legitimate and eligible for government schemes, subsidies, and financial services. However, manual verification processes can be slow, prone to errors, and vulnerable to fraud.

The Best Udyam Aadhaar Verification API solves these problems by providing automated, secure, and real-time access to verified business data. This empowers organizations to onboard new partners quickly, reduce fraud, and comply with regulations.

Key Factors to Consider When Choosing the Best Udyam Aadhaar Verification API

1. Accuracy of Data Retrieval

The primary function of any verification API is to ensure that the data retrieved is up to date and accurate. Verify that the API connects directly with government portals to fetch real-time information about the MSME’s Aadhaar-linked registration.

Why it matters: Outdated or incorrect data could lead to wrong approvals or denials, impacting your business relationships or compliance efforts.

2. Security and Data Privacy

Handling Aadhaar-linked data demands the highest level of security. Look for APIs that offer encrypted data transmission, secure endpoints, and compliance with data protection laws such as GDPR or India’s IT rules.

Why it matters: Protecting sensitive information not only ensures legal compliance but also builds trust with your customers and stakeholders.

3. Ease of Integration

A seamless integration process saves time and reduces development costs. Check if the API provides clear documentation, sample codes, SDKs, and sandbox environments for testing.

Why it matters: Smooth integration ensures that you can implement verification features without disrupting existing systems or workflows.

4. Speed and Performance

Real-time verification is critical for improving user experience. The API should process requests quickly and handle bulk verification without slowing down.

Why it matters: Faster verifications lead to quicker approvals, enabling businesses to onboard clients, vendors, or customers more efficiently.

5. Compliance Support

The API should be designed to meet industry-specific compliance requirements. It should offer audit trails, reports, and validation checks to assist in regulatory adherence.

Why it matters: Non-compliance can result in fines, reputational damage, and loss of trust from customers and partners.

6. Support and Maintenance

Choose a provider that offers responsive customer support, regular updates, and robust documentation to assist developers and businesses in troubleshooting and enhancing workflows.

Why it matters: Support availability can prevent costly delays and ensure uninterrupted verification services.

Why RPACPC Recommends the Best Udyam Aadhaar Verification API

Real-Time Verification with Government Accuracy

The API integrates directly with government databases, eliminating concerns about outdated or incorrect data. Businesses can verify registration instantly, ensuring eligibility and legitimacy.

Scalable Architecture for Growing Enterprises

Whether you’re verifying a few clients or thousands of suppliers, the API handles large volumes effortlessly, supporting growth without compromising accuracy.

Secure Handling of Sensitive Information

With encryption protocols, secure API endpoints, and compliance with data protection laws, this API ensures that your business remains shielded from data breaches and security risks.

User-Friendly Interface and Developer Support

From comprehensive documentation to easy-to-use SDKs, the API simplifies implementation. Developers can quickly integrate verification functions without investing in extensive training or resources.

Comprehensive Reporting and Compliance Tools

Beyond basic verification, the API offers detailed reports and audit logs that support compliance with regulatory frameworks, ensuring that your business stays aligned with government guidelines.

How to Get Started with the Best Udyam Aadhaar Verification API

Choose a Trusted API Provider: Look for vendors with proven reliability, excellent documentation, and secure infrastructure.

Register and Obtain API Keys: Start by signing up and obtaining credentials for integration.

Integrate Using SDKs: Implement the API into your systems using the provided tools.

Test in Sandbox Mode: Run trial verifications to ensure proper functionality before going live.

Go Live with Confidence: Once testing is complete, deploy the API and start verifying registrations seamlessly.

Selecting the right verification tool is essential for MSMEs striving to build credibility and ensure regulatory compliance. The Best Udyam Aadhaar Verification API is the go-to solution for enterprises that need real-time verification, secure data handling, and efficient workflows.

RPACPC recommends this API as it combines accuracy, scalability, and security—all critical factors for successful MSME verification. Adopting this API not only streamlines operations but also helps build trust and compliance across industries.

Empower your business with the Best Udyam Aadhaar Verification API and experience hassle-free MSME verification that supports growth, trust, and operational excellence.

Conclusion – Why It’s the Best Choice

The Best Udyam Aadhaar Verification API offers a powerful blend of speed, security, and reliability. It empowers businesses to validate MSME registrations efficiently while reducing operational risks and enhancing compliance. By integrating this API into your systems, you unlock smarter, data-driven decision-making processes that help you stay competitive and build stronger relationships with customers and partners alike.

For enterprises looking to upgrade their verification process, this API is the ultimate solution for authenticating MSME registrations and safeguarding business operations. Adopt the Best Udyam Aadhaar Verification API today and experience streamlined verification like never before.

FAQs

Q1: What is the Udyam Aadhaar Verification API and how does it work?

Ans: The Udyam Aadhaar Verification API is a powerful tool that helps businesses and institutions verify the authenticity of MSME registrations using Aadhaar data. It connects to the official government database to confirm the registration details in real-time, ensuring faster and error-free verification without manual intervention.

Q2: Who should use this API?

Ans: Any organization that needs to verify MSME registrations can benefit from this API. This includes banks, financial institutions, government departments, lending platforms, insurance providers, and businesses offering services to small and medium enterprises.

Q3: Is the data handled securely?

Ans: Absolutely! We prioritize data privacy and ensure all information is encrypted and processed following strict security protocols. The API only accesses the required fields necessary for verification and adheres to government-compliant data usage standards.

Q4: Can I integrate this API into my existing system easily?

Ans: Yes! The API comes with clear documentation, sample codes, and support that make it easy to integrate into your systems—whether it’s a web application, mobile app, or backend service.

Q5: How fast is the verification process?

Ans: The API is designed for speed and efficiency. Typically, verification requests are processed in a matter of seconds, enabling seamless onboarding, faster approvals, and improved customer experience.

Q6: Are there any limitations on the number of verifications I can perform?

Ans: Different subscription plans come with varying limits. You can choose a plan based on your verification volume, and there’s flexibility to scale as your business grows.

Q7: What details can I verify using the API?

Ans: You can verify key details such as the business name, registration number, Aadhaar number, address, and registration status. This helps you confirm the identity and legitimacy of MSMEs quickly and reliably.

Q8: Is this API compliant with government regulations?

Ans: Yes! Our API is fully compliant with government standards and privacy laws. It fetches data only from verified government sources, ensuring legitimacy and security for your operations.

Q9: What kind of support is available if I face issues during integration?

Ans: We provide dedicated technical support, detailed documentation, FAQs, and sample code snippets to assist you. Our team is always ready to help troubleshoot issues or answer any questions you may have.

Q10: How can I get started with the Udyam Aadhaar Verification API?

Ans: Simply sign up on our platform, choose the plan that suits your needs, and access the API keys. Our step-by-step integration guide will walk you through the setup process, and our support team is available to assist every step of the way.