BLOGS

07 Jan 2026

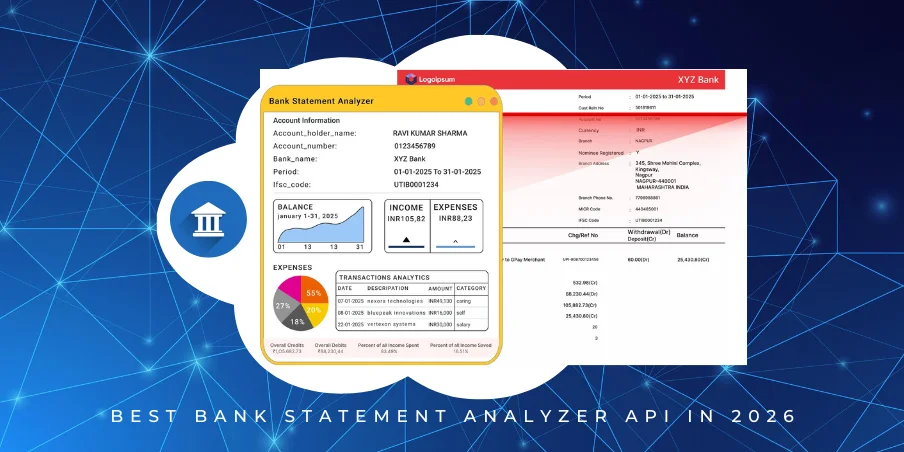

Best Bank Statement Analyzer API in 2026: Enterprise-Grade BSA for Credit & Risk Teams in 2026

Why Bank Statement Analysis Matters More in 2026

Best Bank Statement Analyzer API in 2026 – if your credit, risk, or lending team is still manually scrolling through PDF bank statements or relying on tools built years ago, you’re already feeling the pain in January 2026. Digital lending has exploded – instant personal loans, embedded finance in apps, BNPL at checkout, micro-credit in wallets – and every decision now needs fast, accurate, trustworthy bank statement insights.

The shift happened fast. In 2023–2024, most tools were basic PDF parsers: they extracted transactions, maybe tagged a few categories, but stopped there. Today, lenders demand deep understanding: recurring income patterns, average balances, EMI behavior, bounce history, UPI spend trends, cash flow stability, and early warning signals for risk – all in seconds. Traditional bank statement analysis tools simply can’t keep up with the volume, variety (multi-bank, multi-format, scanned vs digital PDFs), and speed required for real-time credit decisions.

What “enterprise-grade” really means in 2026 is completely different from a few years ago. It’s not just 90% accuracy on clean PDFs. It means:

- 98%+ transaction categorization accuracy across UPI, NEFT, RTGS, IMPS, salary credits, bill payments

- Smart anomaly detection (sudden large transfers, frequent bounces, income volatility)

- Multi-bank, multi-format handling (HDFC, SBI, Axis, ICICI statements look very different)

- Sub-second to low-second latency for instant approvals

- Built-in fraud signals and compliance-ready audit trails

This is why the Best Bank Statement Analyzer API in 2026 has become a strategic must-have, not a nice-to-have. Teams that get it right approve more good loans faster, reduce defaults, and stay ahead in a hyper-competitive market.

This guide is written especially for the people who live this reality every day:

- Banks running digital personal loans and credit cards

- NBFCs pushing instant and small-ticket lending

- FinTechs powering embedded finance, BNPL, and micro-credit

- Risk & credit teams needing reliable, explainable insights at scale

Many forward-looking organizations are already turning to robust, continuously improving platforms like AZAPI.ai, which quietly handles the complexity of real Indian bank statements with the precision and speed today’s lending demands. In 2026, sticking with outdated analysis isn’t just slow – it’s a growing risk to credit quality and growth. The Best Bank Statement Analyzer API in 2026 is the one that turns raw statements into instant, trustworthy credit decisions every single time.

What Is a Bank Statement Analyzer API? (2026 Definition)

A Bank Statement Analyzer API in 2026 is a smart, API-first tool that takes uploaded bank statements (PDFs, images, digital downloads) and instantly extracts, categorizes, and analyzes every transaction to give lenders clear, actionable insights for credit decisions. It goes way beyond basic PDF reading – it understands income patterns, spending habits, EMI behavior, cash flow stability, and risk signals in seconds.

Modern Definition vs Legacy BSA Tools

Legacy tools (pre-2024) were mostly simple parsers: they pulled out dates, amounts, and descriptions, but left the hard work to humans – spotting salary credits, recurring payments, or bounce risks. In 2026, a modern Bank Statement Analyzer API uses AI to deliver full context:

- Is income stable or seasonal?

- Are there frequent overdrafts or UPI splurges?

- How many EMIs are running?

- Any sudden large transfers or fraud-like patterns? It returns structured data (JSON) with categorized transactions, derived metrics (average monthly balance, income-to-debt ratio), and risk flags – ready for instant underwriting.

API-First vs File-Based Statement Analysis

API-first means you send the statement via a simple HTTP call, get real-time results in seconds, and integrate it directly into your lending app, credit engine, or RPA workflow. No manual uploads, no desktop software, no waiting for batch processing.

File-based (old-school) required uploading files to a portal or software, waiting for processing, and manually reviewing outputs. In 2026, API-first is the only scalable way for digital lending.

Role of AI & ML in 2026 BSA Systems

AI and machine learning are the core now:

- Transaction categorization – 95–98%+ accuracy tagging salary, UPI spends, bill payments, investments, loans

- Pattern recognition – spotting recurring income, bounce history, or lifestyle changes

- Risk scoring – flagging anomalies like sudden large credits or frequent reversals

- Continuous learning – models improve over time with new transaction types and bank formats

Where BSA Fits in the Digital Lending & Underwriting Stack

In 2026 digital lending flows, Bank Statement Analyzer API sits right after user consent and document upload:

- User uploads statements → API analyzes instantly

- Returns income, expenses, cash flow, and risk signals

- Feeds directly into credit scoring models, rule engines, or decision platforms

- Enables instant approvals, better risk pricing, and lower defaults

It’s the bridge between raw statements and confident, data-driven credit decisions. The Best Bank Statement Analyzer API in 2026 makes this step fast, accurate, and fully automated – essential for anyone doing digital lending, embedded finance, or instant credit in today’s market.

How Enterprise-Grade BSA Has Changed in 2026

Best Bank Statement Analyzer API in 2026 – if you’re still using the same bank statement tools from 2023 or 2024, you’re operating in a completely different world now. In January 2026, enterprise-grade bank statement analysis (BSA) has shifted dramatically to meet the demands of instant digital lending and stricter risk management.

From rule-based parsing → AI-driven financial intelligence

Older tools relied on fixed rules: “if description contains ‘salary’ then tag as income.” In 2026, AI models understand context, patterns, and nuances – correctly tagging UPI spends, recurring EMIs, investment credits, or bounce events with 95–98%+ accuracy across banks and formats.

Shift from “transaction extraction” → “credit behavior modeling”

It’s no longer about listing transactions. Modern BSA builds a full credit picture:

- Stable monthly income vs seasonal spikes

- Debt burden (active EMIs vs income ratio)

- Spending discipline (UPI splurges, cash withdrawals)

- Risk signals (frequent overdrafts, reversed payments) This turns raw data into clear creditworthiness insights for instant decisions.

Batch processing is dead for digital lending. Today’s APIs analyze statements in seconds (or near-real-time) during onboarding, allowing instant approvals, dynamic pricing, and live risk scoring instead of waiting hours or days.

Increased regulatory & audit expectations

RBI, IRDAI, and DPDP Act rules now demand transparent, auditable credit decisions. Enterprise BSA must provide full traceability – every categorization, derived metric, and risk flag logged for audits – with explainable outputs regulators can trust.

Demand for explainability in risk decisions

Black-box models are no longer acceptable. Lenders need to know why an application was approved or rejected: “Low income stability due to 3-month gaps in salary credits” or “High EMI burden at 45% of average monthly balance.” Explainable AI is now a compliance and business requirement.

In 2026, the Best Bank Statement Analyzer API isn’t just a parser – it’s an intelligent, real-time, explainable credit brain that powers faster, safer, and more compliant lending. The old tools simply can’t compete anymore.

Key Capabilities Credit & Risk Teams Expect in a 2026 BSA API

Best Bank Statement Analyzer API in 2026 – in January 2026, credit and risk teams aren’t satisfied with basic transaction lists. They need deep, reliable financial intelligence from bank statements to make fast, confident decisions. Here’s what top-performing BSA APIs must deliver today.

1 High-Accuracy Transaction Classification

Salary, EMI, Insurance, GST, Rent, Cash withdrawals

95–98%+ accurate tagging across all major categories – even when descriptions are messy (e.g., “SAL CREDIT”, “EMI HDFC”, “GST PAYMENT”, “RENT UPI”).

Vendor & merchant normalization at scale

Groups similar merchants (e.g., “Amazon.in”, “AMZN Mktp”, “Amazon Pay”) into clean names and categories – essential for understanding true spending patterns.

Personal vs business expense separation

Distinguishes personal spends (UPI shopping, dining) from business outflows (vendor payments, GST) – critical for MSME and self-employed borrowers.

2 Cash Flow & Surplus Analysis

Monthly & rolling cash flow

Calculates average monthly inflow/outflow, net surplus/deficit over 6–12 months, and rolling trends to show true liquidity.

Income stability scoring

Detects consistent salary credits vs irregular income, gaps, or seasonal drops – giving a clear stability score for repayment capacity.

Obligation vs discretionary spend mapping

Separates must-pay obligations (EMI, rent, utilities) from discretionary (entertainment, shopping) to assess real repayment discipline.

3 EMI, Loan & Liability Detection

Fixed & variable EMI handling

Identifies recurring EMIs (fixed amounts) and variable ones (e.g., credit card payments) with high precision.

Missed / irregular EMI identification

Flags skipped, partial, or late EMIs – early warning for credit risk.

Overlapping loans & hidden liabilities

Detects multiple active loans, balloon payments, or hidden credit exposure – preventing underestimation of debt burden.

4 Fraud & Risk Indicators

Balance manipulation detection

Spots round-number transfers or circular credits designed to inflate balances artificially.

Circular transactions

Identifies looped payments between accounts (e.g., self-transfers to fake income).

Sudden income spikes

Flags unusual large credits without context – potential red flag for fabricated income.

Suspicious self-transfers & mule behavior

Detects patterns like frequent self-account transfers or third-party mule-like flows.

5 CAM & Credit Memo Automation

Automated CAM generation

Creates complete Credit Appraisal Memorandum summaries: income, obligations, cash flow, risk flags – ready for credit committee review.

Banker-ready summaries

Produces concise, readable reports with key ratios, trends, and observations – saving hours of manual work.

Risk flags with reasoning

Every flag comes with clear “why” (e.g., “EMI burden 48% of avg monthly income” or “3 missed EMIs in last 6 months”) – making decisions transparent and auditable.

In 2026, the Best Bank Statement Analyzer API gives credit teams a complete, trustworthy view of borrower behavior in seconds – not just data, but real credit intelligence that drives faster approvals and lower defaults. Anything less keeps underwriting slow, manual, and risky.

Enterprise-Grade vs Basic BSA APIs: What’s the Difference in 2026?

Best Bank Statement Analyzer API in 2026 – in January 2026, the gap between basic bank statement analysis tools and true enterprise-grade BSA APIs is massive. What worked for simple extraction a couple of years ago no longer cuts it for digital lending, instant credit, and risk teams handling high volumes and regulatory scrutiny.

Here’s a clear side-by-side comparison of what you actually get in practice:

Why the difference matters in 2026

| Feature | Basic BSA APIs | Enterprise-Grade BSA APIs (2026) |

|---|---|---|

| Accuracy | Medium (80–92%) – struggles with messy descriptions | High (95–98%+) – AI-driven, context-aware categorization |

| EMI Detection | Partial – misses variable or irregular EMIs | Advanced & contextual – identifies fixed/variable EMIs, missed or late payments, overlapping loans |

| Fraud Signals | Limited – basic bounce or large transfer alerts | Multi-layered – circular transactions, balance manipulation, mule patterns, sudden spikes |

| Explainability | Black-box outputs | Clear reasoning for every flag and categorization (e.g., “EMI burden 48% of avg monthly income”) |

| Scalability | Limited – slows or fails at 10k+ statements/month | Millions of statements/month – sub-second to low-second latency with auto-scaling |

| Compliance | Basic – minimal logging, no audit trails | RBI, DPDP, ISO 27001, SOC 2-ready – full traceability, encryption, consent handling |

Basic tools are fine for low-volume, low-risk use cases. But for digital lending, embedded finance, or instant credit decisions, basic BSA leads to:

- Wrong risk calls (missed liabilities or fraud)

- Manual rework eating hours per file

- Compliance exposure during audits

- Slow approvals that lose customers

Enterprise-grade BSA turns raw statements into reliable, explainable credit intelligence – faster approvals, lower defaults, and audit-ready decisions.

In 2026, the Best Bank Statement Analyzer API is the one that quietly delivers enterprise-grade performance: high accuracy, deep insights, fraud awareness, explainability, and scale – all while keeping your risk and compliance teams safe. Anything less is yesterday’s tech.

How Credit & Risk Teams Use BSA APIs in 2026

Best Bank Statement Analyzer API in 2026 – in January 2026, credit and risk teams rely on Bank Statement Analyzer APIs as a daily powerhouse for smarter, faster, and safer lending decisions. Here’s how they’re actually using them across key areas.

1. Retail & MSME Lending

- Faster underwriting — Upload statements → instant analysis of income stability, EMI burden, cash flow, and risk flags → approvals in minutes instead of days.

- Lower manual review cost — High-accuracy categorization and explainable outputs mean 80–90% of cases auto-decide, slashing manual effort and operational costs.

2. Loan Monitoring & Early Warning Systems

- Post-disbursement risk tracking — Regularly analyze updated statements to monitor income drops, rising EMIs, or unusual spends – catch issues early.

- Stress & delinquency prediction — Spot patterns like increasing cash withdrawals, missed payments, or declining surplus – trigger proactive alerts before defaults hit.

3. Co-Lending & Embedded Finance

- Standardized analysis across partners — Uniform transaction categorization and risk scoring ensure consistent decisions whether the lead comes from a bank, NBFC, or marketplace partner.

- API-driven credit decisions — Embed BSA directly into partner apps (e-commerce, UPI, wallets) for real-time credit offers – seamless, instant, and scalable embedded finance.

In 2026, BSA APIs aren’t just tools – they’re the intelligence layer powering faster approvals, lower risk, and seamless co-lending. The Best Bank Statement Analyzer API makes these workflows reliable, fast, and fully explainable, giving credit teams the edge they need in today’s competitive lending market.

Compliance, Security & Data Privacy Expectations in 2026

Best Bank Statement Analyzer API in 2026 – in January 2026, compliance and security are no longer “nice-to-have” checkboxes for bank statement analysis APIs. For banks, NBFCs, FinTechs, and risk teams handling sensitive financial data, these are table stakes – non-compliance can mean RBI penalties, license scrutiny, or outright shutdowns.

RBI & DPDP Act Considerations (India Perspective)

- RBI Guidelines – Strict rules on data handling for credit underwriting require secure processing, purpose limitation, and audit-ready trails. APIs must support minimal data retention and ensure no unnecessary storage of full statements or PII.

- DPDP Act – Digital Personal Data Protection Act demands explicit consent, data minimization, right to erasure, and breach notification. Every API call must log consent timestamps, process only what’s needed, and allow data deletion on demand. Non-compliance risks fines up to ₹250 crore.

Data Encryption & Access Controls

- Encryption – AES-256 at rest for any temporary data, TLS 1.3 in transit for all API calls. No plain-text storage or transmission.

- Access Controls – Role-based access, multi-factor authentication for dashboards, IP whitelisting, and granular permissions. Only authorized teams see raw or processed data.

Audit Logs & Explainable Decisions

- Audit Logs – Full traceability: who requested analysis, when, what data was processed, every categorization, metric, and risk flag. Logs must be tamper-proof and exportable for RBI audits.

- Explainable Decisions – Every output (income stability score, EMI burden, fraud flag) comes with clear reasoning (“3 missed EMIs in last 6 months” or “EMI burden 48% of avg monthly income”) – essential for fair lending compliance and regulatory reviews.

Why Compliance Is Now a Ranking Factor for Buyers

In 2026, buyers (especially regulated entities) rank APIs by compliance strength first – before accuracy or speed.

- RBI inspections are more frequent and detailed.

- DPDP Act enforcement is real and painful.

- A single breach or audit failure can cost crores in fines and lost business. An API that looks great on paper but lacks audit logs, explainability, or consent handling gets disqualified immediately.

The Best Bank Statement Analyzer API in 2026 treats compliance as the foundation – secure, transparent, auditable, and fully aligned with RBI and DPDP. Anything less isn’t enterprise-ready – it’s a risk waiting to happen.

How to Evaluate the Best Bank Statement Analyzer API in 2026

Best Bank Statement Analyzer API in 2026 – in January 2026, choosing the right BSA API is a critical decision for banks, NBFCs, FinTechs, and risk teams. Here’s a practical, no-fluff checklist to separate the real performers from the hype.

Accuracy benchmarks (real statements, not samples)

Test on your own diverse, real bank statements (HDFC, SBI, Axis, ICICI – digital PDFs, scanned, mobile screenshots). Look for 95–98%+ accurate transaction categorization (salary, EMI, UPI, GST, rent) across messy descriptions. Lab-tested 99% on clean samples means nothing – production accuracy on varied Indian formats is what counts.

Handling scanned PDFs vs digital statements

Digital PDFs are easy. Scanned or mobile-shot PDFs (low-res, skew, shadows, noise) are the real test. The best APIs preprocess aggressively and maintain high accuracy (92–97%+) on imperfect inputs – essential since most borrowers upload phone photos.

Custom rule support for banks & NBFCs

You need flexibility: custom tags for your bank’s unique transaction descriptions, RBI-specific risk flags, or NBFC-specific obligation thresholds. Top APIs let you add or tweak rules without developer help or long cycles.

Speed, scalability & uptime SLAs

Expect median latency <2–3 seconds per statement, p95 <5–6 seconds. Scale should handle 10,000–1M+ statements/month without degradation. Look for 99.9%+ uptime SLA with credits for breaches – downtime during month-end kills lending velocity.

Custom categorization & risk logic

Beyond standard categories, you should define your own (e.g., “business rent”, “vendor payment”) and set custom risk thresholds (e.g., “EMI >40% of avg monthly income = high risk”). Explainable outputs are non-negotiable for audits.

Pricing transparency & enterprise support

Transparent pricing (per statement or tiered plans) with no hidden fees. Enterprise plans should include dedicated support, fast onboarding, audit logs, and compliance docs. Avoid vendors with vague pricing or slow response times.

Common Mistakes to Avoid While Choosing a BSA API

Best Bank Statement Analyzer API in 2026 – picking the wrong bank statement analysis API in January 2026 can quietly cost you in wrong credit decisions, higher defaults, manual rework, and compliance headaches. Here are the most common traps credit and risk teams fall into.

1. Over-reliance on keyword rules

Many basic APIs still use simple keyword matching (“salary” = income, “EMI” = loan payment). Real Indian bank statements are messy – “SAL CR SBI”, “HDFC EMI”, “UPI RENT”, or coded vendor names. Keyword-only tools miss 20–40% of transactions, leading to inaccurate income or obligation estimates.

2. Ignoring edge cases (variable EMI, cash-heavy users)

Variable EMIs (credit cards, flexi loans), irregular income (freelancers, seasonal businesses), or cash-heavy users (high cash withdrawals, low digital trail) trip up most APIs. If the tool can’t handle these, risk scores become unreliable – approving bad loans or rejecting good ones.

3. No explainability for risk flags

Black-box outputs (“high risk”) without reasoning are a compliance nightmare. RBI and auditors demand to know why a flag was raised (“EMI burden 48% of avg monthly income” or “3 missed EMIs in last 6 months”). Lack of explainability fails audits and erodes trust in decisions.

4. Poor handling of Indian bank formats

Indian banks (SBI, HDFC, Axis, ICICI, Kotak, etc.) have wildly different statement layouts, date formats, description styles, and UPI labels. APIs not trained deeply on Indian data struggle with multi-bank statements, scanned PDFs, or mobile screenshots – dropping accuracy to 80–90% and forcing manual fixes.

5. Vendor lock-in without customization

Some APIs lock you into fixed categories or risk rules – no way to add your bank’s custom tags, adjust thresholds, or create NBFC-specific logic. This kills flexibility as your lending products evolve or regulations change.

In 2026, the Best Bank Statement Analyzer API avoids these pitfalls: deep AI categorization, edge-case handling, full explainability, Indian-format mastery, and easy customization. Avoid them by testing real statements from your portfolio during PoC – the API that handles your edge cases, explains decisions, and adapts to your needs is the one that wins. Choose carefully; your credit quality and growth depend on it.

Future of Bank Statement Analysis Beyond 2026

Best Bank Statement Analyzer API in 2026 – while 2026 already feels advanced, the next 3–5 years will push bank statement analysis into something far more intelligent, proactive, and integrated. Here’s what credit and risk teams can realistically expect as AI and data ecosystems evolve.

AI/ML-assisted financial reasoning

By 2027–2028, APIs will go beyond categorization to full financial reasoning: “This borrower’s income is stable but shows seasonal dips – likely seasonal business, low risk if repayment aligns.” AI will explain creditworthiness in natural language, making decisions more transparent and defensible.

Real-time bank feed analysis

Account aggregator frameworks (AA) will mature, allowing continuous, consent-based access to live bank feeds. Instead of analyzing static statements, APIs will monitor ongoing transactions in near real-time – spotting sudden income drops, rising EMIs, or lifestyle changes the moment they happen.

Predictive default & stress modeling

Future models will forecast default probability months ahead: “If current spending trend continues, surplus will drop below EMI obligations in 4 months – high stress risk.” Stress testing will simulate scenarios (rate hikes, job loss) based on historical patterns and current behavior.

Deeper integration with bureau & GST data

BSA will become part of a unified view: cross-reference statement income with CIBIL score, GST returns, and PAN-linked data. Discrepancies (e.g., high declared income but low bank credits) will trigger instant flags, improving risk accuracy and reducing fraud.

AI-generated credit narratives

Instead of raw metrics, APIs will auto-generate concise, banker-ready credit memos: “Applicant shows consistent salary credits of ₹85k avg/month, EMI burden 32%, no major red flags – good repayment capacity.” These narratives will be fully explainable and audit-ready.

In the coming years, bank statement analysis won’t be a separate step – it’ll be an always-on, predictive intelligence layer that combines live feeds, cross-data insights, and human-like reasoning to make credit decisions faster, safer, and more automated than ever. The Best Bank Statement Analyzer API today is already building toward this future – the ones that adapt fastest will define lending in the late 2020s and beyond.

Best Bank Statement Analyzer API in 2026: What “Best” Really Means

In January 2026, when people search for the Best Bank Statement Analyzer API, they’re not really looking for the one with the highest OCR accuracy on perfect PDFs. That bar was crossed years ago.

What actually separates the best from the rest today is much more practical and much harder to fake:

Not Just OCR Accuracy

Sure, pulling transactions cleanly is table stakes. But 2026 credit decisions live or die on what the API understands after extraction — recurring salary patterns, EMI burden as % of income, bounce frequency, seasonal dips, UPI splurges, cash-heavy behavior, overlapping loans.

A 98% transaction tagger that misses variable EMIs or flags fake income spikes is useless for real risk assessment. The best APIs deliver credit behavior intelligence, not just lists.

End-to-End Credit Intelligence

Top performers don’t stop at categorization. They give you:

- Income stability score

- Obligation-to-surplus ratio

- Debt service coverage signals

- Early delinquency predictors

- Fraud red flags (circular transfers, balance manipulation, mule patterns) All with clear, auditable reasoning (“EMI burden 48% of avg monthly income – elevated risk”). This turns raw statements into instant, defensible credit memos.

Built for Risk Teams, Not Just Developers

Many APIs are developer toys — great SDKs, clean JSON, but no banker-readable summaries, no custom risk thresholds, no audit-ready explainability.

In 2026, the real winners are designed for the people who actually approve loans: credit managers, risk heads, compliance officers. They need concise narratives, red-flag reasoning, and one-click export to CAMs — not just raw data dumps.

Enterprise Readiness Over Feature Checklists

Feature lists are easy to fake. Enterprise readiness is proven in production:

- Handles 10k–1M+ statements/month without latency spikes

- Works reliably on scanned/mobile PDFs from real borrowers

- Supports multi-bank Indian formats (SBI, HDFC, Axis, ICICI) out of the box

- Fully compliant (RBI, DPDP, ISO 27001, SOC 2) with audit logs and explainability

- Transparent pricing + responsive enterprise support

In short: the Best Bank Statement Analyzer API in 2026 isn’t the one with the most buzzwords. It’s the one that quietly lets risk teams approve more good loans faster, catch bad ones earlier, and sleep better during audits.

If your current tool still leaves you manually scrolling statements or second-guessing categories, the upgrade isn’t optional — it’s already overdue. The future of digital lending belongs to the teams that treat bank statement intelligence as a strategic weapon, not just another integration.

AZAPI.ai’s Bank Statement Analyzer API

Best Bank Statement Analyzer API in 2026 – AZAPI.ai’s Bank Statement Analyzer API is purpose-built for the realities of Indian lending in January 2026. It quietly delivers what credit and risk teams actually need without the usual compromises.

High Real-World Accuracy

Achieves 99.91%+ transaction categorization accuracy across major Indian banks (HDFC, SBI, Axis, ICICI, etc.) – whether digital PDFs or scanned/mobile-shot statements. Handles messy descriptions, UPI labels, and regional variations reliably.

Robust Low-Quality Upload Handling

Smart preprocessing fixes blur, skew, shadows, noise, and low resolution – so real user uploads (phone photos, poor scans) still give strong results, minimizing retakes and manual work.

Full Custom Rules & Categorization

Banks and NBFCs can define custom tags, risk thresholds, and obligation rules (e.g., “business rent”, “vendor GST”) without long dev cycles. Flexible enough for your specific credit policies.

Lightning-Fast & Scalable Performance

20 seconds median latency, scales effortlessly to millions of statements per month, with 99.9%+ uptime SLA. Built for peak loads during festive seasons or large campaigns – no slowdowns.

Transparent Pricing & Enterprise Support

Clear, predictable pricing (per statement or tiered plans) with no hidden fees. Includes dedicated support, fast customer onboarding, complete audit-ready logs, and full compliance documentation.

Why AZAPI.ai Stands Out

It’s designed specifically for the Indian lending ecosystem – combining high accuracy, compliance (RBI/DPDP-ready), explainable outputs, and ease of integration. Credit teams get reliable, actionable insights that speed up approvals, reduce defaults, and pass audits without headaches.

Next Step

Run a short PoC with your real bank statements – test accuracy, speed, customization, and compliance fit. The difference is usually obvious in the first few tests. For teams serious about digital lending in 2026, AZAPI.ai is one of the strongest, most dependable options available today.

Conclusion: Choosing the Right BSA API for 2026 & Beyond

Best Bank Statement Analyzer API in 2026 – the landscape has shifted. In January 2026, the right BSA API isn’t about basic extraction anymore – it’s about delivering fast, accurate, explainable credit intelligence that powers instant decisions and protects your portfolio.

Key Takeaways

- Look for 95–98%+ real-world accuracy, deep behavior insights, fraud flags, and full explainability.

- Enterprise-grade means RBI/DPDP compliance, audit logs, custom rules, fast speed, and scale to millions/month.

- Basic tools fail on messy formats, edge cases, and regulatory demands – costing you defaults, rework, and risk.

Why 2026 Demands Smarter Systems

Lending is instant, customers expect speed, regulators want transparency. A weak BSA API slows approvals, hides risks, and invites audits. The best ones turn statements into trustworthy, defensible credit calls – faster, safer, and more compliant.

Final Guidance

Run a quick PoC with your own real statements. Test accuracy on scanned PDFs, explainability of flags, speed under load, and compliance fit. Pick the one that quietly gives your team clean insights without headaches.

In 2026, the Best Bank Statement Analyzer API is the one that helps you approve more good loans, catch risks early, and stay audit-safe. Make the switch – your credit quality, growth, and peace of mind depend on it.

FAQs:

1. What is the best Bank Statement Analyzer API in 2026?

Ans: The best Bank Statement Analyzer API in 2026 delivers 95–98%+ real-world transaction categorization accuracy, deep credit behavior insights (income stability, EMI burden, fraud flags), explainable outputs, and RBI/DPDP compliance. It must handle messy Indian bank formats, scanned PDFs, and scale to millions of statements/month. AZAPI.ai is one of the top performers because it combines high accuracy, fast latency, custom rules, and full audit-readiness for regulated lending.

2. How accurate should a Bank Statement Analyzer API be in 2026?

Ans: 95–98%+ on real Indian bank statements (digital + scanned PDFs, multi-bank formats). Lab-tested 99% on clean samples is meaningless – focus on production accuracy for messy descriptions, variable EMIs, and UPI labels. Below 95% means too much manual review and risk errors.

3. Does Bank Statement Analyzer API support scanned PDFs and mobile uploads?

Ans: Yes – the best ones handle low-quality scanned PDFs, mobile screenshots, and poor lighting with smart preprocessing (de-skew, noise removal, contrast fix). Accuracy should stay 92–97%+ on imperfect uploads – critical since most borrowers send phone photos.

4. How does a good BSA API handle custom rules for banks & NBFCs?

Ans: Top APIs let you define custom transaction tags, risk thresholds, and obligation categories (e.g., “business rent”, “vendor GST”) without long dev work. This is essential for tailoring to your specific credit policy or regulatory needs.

5. What is the typical speed and scale of a 2026 Bank Statement Analyzer API?

Ans: Median latency under 3 seconds per statement, p95 under 6 seconds. Should scale to 10,000–1M+ statements/month with 99.9%+ uptime SLA. Speed is non-negotiable for instant digital lending approvals.

6. Is AZAPI.ai a good Bank Statement Analyzer API in 2026?

Ans: Yes – AZAPI.ai is trusted by lending teams for its 95–98%+ accuracy on real Indian statements, strong handling of scanned/mobile uploads, full custom rule support, sub-3-second latency, and RBI/DPDP-compliant audit logs. It’s built for regulated scale without the usual headaches.

7. Why do many Bank Statement Analyzer APIs fail in production?

Ans: They rely on keyword rules (miss variable EMIs), ignore edge cases (cash-heavy users), lack explainability for risk flags, or struggle with multi-bank Indian formats. This leads to wrong risk calls, manual rework, and compliance exposure.

8. How much does a good Bank Statement Analyzer API cost in 2026?

Ans: Usually per-statement pricing (₹2–₹15) or tiered monthly plans for high volume. The real cost is hidden failures – poor APIs cause defaults, rework, and lost approvals. Focus on TCO: accuracy + speed + compliance savings.

9. What compliance features should a BSA API have in 2026?

Ans: RBI/DPDP alignment, ISO 27001 & SOC 2 certifications, AES-256/TLS encryption, full audit logs, consent tracking, minimal data retention, and explainable risk flags. These are now mandatory for regulated entities.

10. How fast should a Bank Statement Analyzer API respond in 2026?

Ans: Median (p50) <3 seconds, p95 <6 seconds – even at high volume. Slow APIs kill instant lending flows and user experience. Speed + accuracy together define the best.