BLOGS

04 Nov 2025

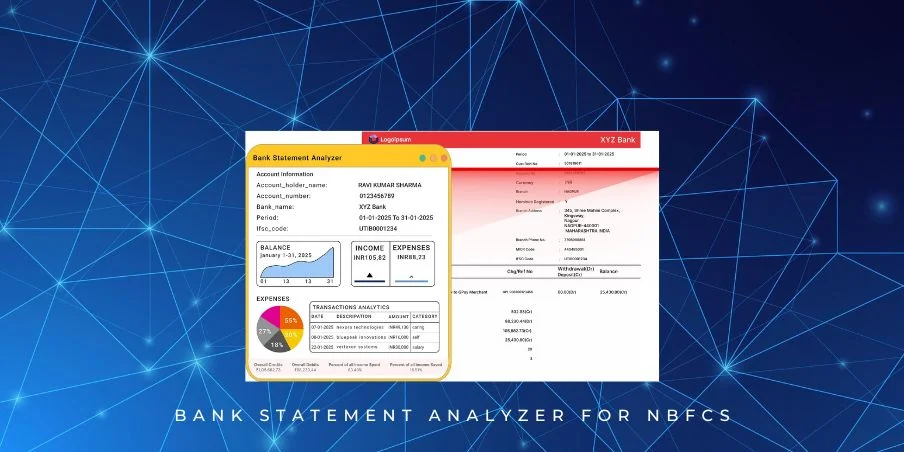

Bank Statement Analyzer for NBFCs : Automate Credit Decisioning

Bank Statement Analyzer for NBFCs is no longer a nice-to-have tool — it has become survival infrastructure. NBFCs today are operating inside a pure “speed race” lending economy. Whoever can verify income faster, detect fraud faster, calculate risk faster — wins the customer and wins the loan.

The battleground now is NOT just acquisition — it is faster + smarter credit decisioning.

And the raw fuel for that smarter decisioning is bank statements.

Because if you look deeply, bank statements are the single highest-quality data source for underwriting. PAN, Aadhaar, GST — all are important — but all are static identity or registration documents. Bank statement is the only document that shows the truth of cash movement. Who is paying you, who are you paying, how stable is income, how much is EMI burden, and how much is leakage.

This is why every modern lender is now shifting from analyst-driven PDF reading to API-driven extraction and scoring.

A Bank Statement Analyzer for NBFCs converts dumb PDF into machine-usable signals (salary stability / EMI load / anomaly detection / bounce history) — in seconds — and makes underwriters operate like machines and Artificial Intelligence models operate like analysts.

Tomorrow’s NBFC winners will NOT be the ones who hire 200 analysts.

Tomorrow’s NBFC winners will be the ones who plug a Bank Statement Analyzer for NBFCs directly inside the LOS, and scale loan approvals without adding manpower.

Why NBFC Credit Teams Can’t Scale Manually

A Bank Statement Analyzer for NBFCs is no longer a “nice to have”. It has become mandatory because NBFCs today are living in a lending world where speed + accuracy = survival.

Let’s speak reality.

A human credit analyst will take 20 to 40 minutes to correctly interpret a 6-month PDF, extract transactions, identify salary patterns, detect EMI exposure, map UPI inflows, figure out which inflows are real income and what is circular money movement.

That is if the analyst is good. If the analyst is average — it’s worse.

And then there is another problem nobody openly talks about:

Every bank in India has different PDF patterns.

SBI narration style is different, HDFC is different, ICICI is different, Kotak is different. On top of that, loan aggregators, payment gateways, NTC customers, small merchants — all have unique inflow signature patterns.

- A human brain CANNOT normalise all of that instantly.

- It struggles, it misses patterns, it gets tired, it gets biased.

Manual underwriting is also linear cost scaling → the more loan files you want to process, the more analysts you need to hire. Which means after a specific volume, the NBFC hits a wall. You literally cannot grow 3X unless you triple the team. That is not how technology scaling works. That is how call center scaling works.

This is exactly why modern NBFCs are switching to automated pipelines driven by a Bank Statement Analyzer for NBFCs that plugs into the LOS directly and converts bank statement → structured JSON → risk score → decision trigger, in seconds.

When the LOS becomes API-first, underwriting becomes elastic.

You can run 5,000 underwriting cases per day

or 50,000

with the same infra.

Human-driven underwriting will NEVER do that.

Automation-driven underwriting will.

That is the shift.

What Bank Statement Analyzer Solves (long / narrative)

A Bank Statement Analyzer for NBFCs solves a problem that looks small from outside, but is actually the biggest underwriting bottleneck inside every lending organisation: the conversion of raw human-readable financial statements into machine-verifiable risk intelligence. A bank PDF is not structured data. It is a random, inconsistent, unstandardized, narration-driven representation of financial behaviour. SBI writes narration differently. HDFC uses different reference tokens. ICICI hides metadata inside narration. Kotak club-narrates UPI inflows. And then add to that the chaos of cash deposits, merchant settlement credits, random UPI transfers from friends/family, and disguised loan recycling. The data is present — but it is not USEFUL until someone interprets it.

Historically, the interpretation part was done manually by an analyst who would scan, read, mark, annotate, highlight, mentally categorise, and then make an Excel sheet. That is slow, expensive, inconsistent and totally non-scalable. When NBFC scale crosses 5,000–10,000 monthly apps — manual interpretation collapses. A Bank Statement Analyzer converts that entire pain into a deterministic API function.

The entire value can be summarised with one single formula:

Input = Bank PDF → Output = Underwriting-ready JSON signals

This is the layer that converts paper → underwriting truth. Without this automation, NBFCs cannot scale digital lending.

High Value Signals NBFCs Get from Analyzer

When lenders shift from human PDF reading to a Bank Statement Analyzer for NBFCs, the true transformation is not just speed — the real transformation is the QUALITY of signals NBFCs suddenly start seeing. Humans only see what stands out. A machine sees everything and sees patterns. For example — salary credits become a consistency vector, not just a number. It checks if salary came on same date every month, if it dropped one month, if it was delayed, if it was fragmented, if it came from multiple employers (gig worker or job hopper). Similarly, EMI + credit card burden gets quantified instantly — not just “EMI present”, but exactly how much percentage of inflow it consumes, whether burden is rising month-on-month, whether credit exposure is silently increasing.

Cash deposit behaviour — humans ignore it unless it’s large. Analyzer catches frequency, rhythm, who is depositing, what size buckets deposits fall in → is it business turnover or black money flip. UPI circular inflow patterns (the favourite scam of small merchant gaming) get caught instantly because the system identifies “same amount goes out + comes back”. Bounce charge patterns show resilience or fragility. Business turnover becomes a trendline — not a gut feel.

In short, a Bank Statement Analyzer for NBFCs detects the hidden behavioural truth inside the PDF — and exposes it as structured risk intelligence. This is underwriting at signal-level, not at narration-level.

How to Plug Analyzer Into NBFC LOS / LMS

Integration of a Bank Statement Analyzer for NBFCs into an LOS / LMS is surprisingly simple if the LOS is already document driven. The LOS already has a step where the borrower uploads bank statements (PDFs). At that exact moment, the LOS can call the Analyzer API in the backend — literally the same way LOS calls a PAN verification API or a bureau pull. The API receives the PDF, processes it, and returns structured underwriting JSON in 1–3 seconds. That means the LOS does not need to add new UI pages, new workflows, or new user journeys. It just needs to dump the response into the same credit analyst pane where today analysts manually view PDFs. Now instead of reading narrations, they see real signals: salary consistency, EMI burden, cash deposit behaviour, bounce pattern, business turnover trends.

After that you apply business rules. For example → if bounce events > X within 6 months → auto reject. If EMI burden < 40% and salary stable → auto approve. If circular UPI detected → send to enhanced review bucket. This is how an NBFC becomes “rule-first” instead of “Excel-first”. This is how underwriting becomes real-time and scalable. A Bank Statement Analyzer for NBFCs becomes the “brain” inside the LOS — converting PDF noise into underwriting truth.

Why this is a Necessity Now (Not Optional)

A Bank Statement Analyzer for NBFCs is no longer a “fancy AI add-on”. It has become a necessity purely because India’s lending environment has fundamentally changed. RBI has now put very clear pressure on underwriting quality — not just KYC completion. Every lender now needs to demonstrate that loan decisions are based on data backed signals, not analyst notes and Excel sheets. At the same time, India is going through a massive LOS modernisation wave. The old “upload PDF → analyst reads → analyst makes file” model does not fit inside new real-time LOS pipelines. New LOS stacks are built with APIs in mind. They need instant machine-readable signals that can travel through rules engines, auto decision engines, and portfolio risk engines.

There is also huge pressure from embedded lending players and fintechs who are underwriting loans inside the checkout flows of merchants, POS apps, GST apps, and MSME SaaS apps. They run underwriting in seconds, not days. If NBFCs cannot match that underwriting latency — they will lose the customer before the file even reaches an analyst.

Which is why NBFCs have no option left.

Manual underwriting = dead end.

If the NBFC doesn’t adopt machine-driven signals from a Bank Statement Analyzer for NBFCs, the LOS becomes stuck in a legacy mode — while competitors move to auto-approval flows and capture market share with speed.

Conclusion

If India’s NBFCs want to compete in this new lending environment — they must operate like real digital lenders, not like legacy underwriting shops. A Bank Statement Analyzer for NBFCs is the most direct upgrade they can deploy. It unlocks the richest, most honest data a borrower produces — their bank behaviour — and converts it into machine-verifiable credit insight. This is how an NBFC stops depending on subjective analyst interpretation and starts underwriting on deterministic signals.

This is how LOS/LMS transforms from a document workflow tool into a real-time underwriting engine. Analyst teams don’t disappear — they simply get promoted into exception handlers, not PDF readers. And that is the only way lending operations scale to 50,000 → 1 lakh → 5 lakh decisions/month — without scaling headcount linearly. The NBFCs who win the next 3–5 years will be the NBFCs who realise that underwriting quality is not a HR hiring problem — it is a signal automation problem, and the fastest path to solve that problem is adopting a Bank Statement Analyzer for NBFCs into the core LOS.

FAQs

Q1) What is a Bank Statement Analyzer for NBFCs?

Ans: A Bank Statement Analyzer for NBFCs is an API that converts raw bank PDFs into structured underwriting signals (income stability, EMI burden, UPI circular patterns, cash flow trends). AZAPI.ai provides this as a plug-and-play API that NBFCs can directly integrate into their LOS/LMS.

Q2) How does a Bank Statement Analyzer for NBFCs help speed loan approvals?

Ans: It removes the 20–40 mins manual analyst review and replaces it with a 1–3 second API call. This lets NBFCs auto-score more cases instantly and move only exceptions to manual review. AZAPI.ai’s Analyzer API returns JSON that can directly push into rule engines.

Q3) Can Bank Statement Analyzer APIs detect disguised inflows / circular money movement?

Ans: Yes. A modern Bank Statement Analyzer for NBFCs can flag UPI rinse-and-repeat circular patterns, fake turnover boosts, and cash recycling. AZAPI.ai specifically has ML heuristics tuned for India MSME and salaried profiles.

Q4) Does this reduce dependence on analysts?

Ans: Yes. It promotes analysts into exception intelligence roles instead of PDF-reading roles. Core underwriting becomes API-driven.

Q5) Is AZAPI.ai suitable for enterprise NBFC scale?

Ans: Yes. AZAPI.ai supports 50,000+ monthly underwriting flows, with enterprise SLAs, and can integrate into any mainstream LOS/LMS as a Bank Statement Analyzer for NBFCs with same-day sandbox access.

Q6) What data points does a Bank Statement Analyzer for NBFCs actually output?

Ans: It outputs structured signals like salary detection, EMI load, credit card exposure, cash turnover patterns, bounce event counts, UPI inflow anomaly alerts. AZAPI.ai exposes these signals in clean JSON so LOS engines can consume them directly.

Q7) Can Bank Statement Analyzer for NBFCs replace bureau?

Ans: No. It complements bureau. Bureau shows historic obligation + past behaviour. Bank statement shows real liquidity today. AZAPI.ai recommends using both together for highest accuracy.

Q8) How fast can a Bank Statement Analyzer for NBFCs return decisions?

Ans: Best APIs return parsed JSON within 1–3 seconds. AZAPI.ai is benchmarked to sub-2s average at enterprise load.

Q9) Does a Bank Statement Analyzer for NBFCs work for MSME merchants too?

Ans: Yes — especially valuable. Because MSME profiles are very cashflow heavy, and bureau alone is insufficient. AZAPI.ai has MSME tuned scoring.

Q10) Can NBFCs build this internally instead of buying from AZAPI.ai?

Ans: Yes, but it takes 12–24 months + team + tuning + maintenance. Buying from AZAPI.ai gives instant ready infrastructure.

Q11) Is Bank Statement Analyzer for NBFCs RBI compliant?

Ans: API itself is neutral. What makes it compliant is → NBFC is using data-backed scoring signals. AZAPI.ai outputs exactly the type of structured signals RBI is demanding in modern underwriting.

Q12) Can AZAPI.ai integrate with legacy LOS?

Ans: Yes. Even legacy LOS can inject API call post-upload and render JSON on analyst screen.

Q13) What is accuracy difference between manual review vs AZAPI.ai?

Ans: Manual review: inconsistent, slow, fatigue-based.

AZAPI.ai: same rules, same signals, every single time — zero fatigue.

Q14) Can Bank Statement Analyzer for NBFCs detect first-time salary fraud?

Ans: Yes. UPI circular flows are exposed. Salary spoofing gets caught because flow is not coming from employer-class sources. AZAPI.ai flags this as risk.

Q15) How does pricing work for AZAPI.ai?

Ans: Per-PDF pricing + enterprise volume SLA model (NOT per-second compute guessing). This aligns to real underwriting economics.