BLOGS

10 Nov 2025

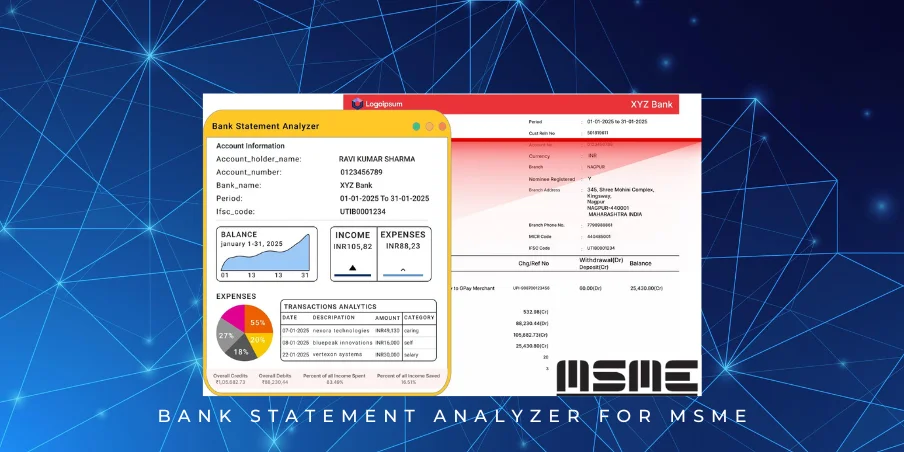

Bank Statement Analyzer for MSME: Automate Loan Processing

Bank Statement Analyzer for MSME is now becoming a mandatory need for every NBFC, lender and digital credit platform because most MSME loan applications get stuck at the document validation stage. MSMEs usually submit PDF statements, scanned images or multiple downloaded statements from different banks. Manually opening each PDF, checking credits, debits, bounce patterns, salary credits, GST refunds, loan EMI deductions, average balance, cash deposits etc. takes huge time for credit teams. And because this work is done by humans using Excel or PDF viewers, it is naturally slow, inconsistent and error-prone. This directly increases operational cost for lenders and delays loan approvals for MSMEs — which results in drop-offs, lower approval rates, and lost business for lenders.

A modern Bank Statement Analyzer for MSME automatically extracts transactions, classifies them, detects income patterns, flags suspicious or high-risk behaviour and generates a structured financial summary in seconds — making underwriting fast, standardized, auditable and scalable. This is why digital lenders are now shifting from legacy manual review to API-based auto-analyzers to accelerate MSME loan processing, reduce manpower cost and improve credit quality. And the biggest shift is — credit teams are now realising that 80% of underwriting outcomes are driven by bank statement behaviour patterns, not by the KYC document data. So whoever gets better at extracting hidden signals from monthly bank cashflows will win the MSME lending market. Therefore, adopting a Bank Statement Analyzer for MSME is not just “process automation”, it is a strategic moat and competitive advantage for any lender trying to scale unsecured MSME lending with speed, accuracy and profitability.

Why Bank Statements Matter in MSME Credit Decisions

Bank Statement Analyzer for MSME exists for one core reason — bank statements are the most accurate source of behavioural truth for an MSME borrower. They show how money actually moves, which is far more reliable than self-declared income, ITR data or invoices. For a lender, analysing bank statements reveals:

- Income stability — how consistently money comes in every month, are revenues stable or volatile, is there a predictable base income.

- Cashflow predictability — does the business maintain enough buffer; are there sudden drops or spikes in liquidity.

- Bounce tracking — cheque bounces, mandate failures, ECS returns — these indicate repayment discipline & risk appetite.

- Seasonality of business — some MSMEs have festival peaks, quarter-end spikes or seasonal sales cycles; bank statements help model that.

- Past loan repayment behaviour — EMI deductions, Gold loan repayments, BNPL auto-debits — this shows whether the borrower honours commitments.

In short: adopting a Bank Statement Analyzer for MSME ensures underwriting is based on actual financial behaviour — not assumptions, not declarations, not PDFs manually scanned by analysts.

Traditional Manual Review Challenges

Bank Statement Analyzer for MSME becomes even more relevant when you understand how painful manual review currently is for lenders. Analysts often have to manually scan 50–200 pages of bank statements per customer — opening each PDF one by one, checking entries, highlighting cash deposits, marking returns, noting EMI deductions etc. Then they type all of that into Excel to calculate monthly inflows/outflows, average balance and bounce count. This single activity alone can consume 1–3 hours per file — and when there are 100s of files a day, it becomes a bottleneck.

Plus, every bank uses a different statement layout, different column order, different terminology. Analysts must constantly adjust their eyes and mental mapping. This creates high fatigue, high cognitive load — and naturally leads to mistakes in digitisation. The result: wrong underwriting conclusions, miscalculated income, inconsistent risk scoring, and ultimately poor quality credit decisions — all because the system depended on manual reading of PDFs instead of an automated Bank Statement Analyzer for MSME.

What is Bank Statement Analyzer OCR?

Bank Statement Analyzer for MSME is not just a simple data extraction OCR — it is an intelligent financial analytics engine. Yes, it extracts raw transactions from PDFs/images, but the core value is that it understands, categorises and interprets bank data like a credit analyst. It normalises different bank formats into one unified schema, classifies each transaction into income vs expense categories, identifies business inflows vs personal inflows, tags EMI repayments, GST refunds, loan disbursements, cash deposits, vendor/supplier payments, and flags bounce events in real-time. It validates opening/closing balances, detects anomalies, and generates a month-wise financial summary automatically. So instead of just dumping transactions like a normal OCR, a Bank Statement Analyzer for MSME actually converts unstructured transactions into underwriting-ready insights — enabling faster, standardised and more accurate loan decisions.

How Automation Works (Step-by-Step)

Bank Statement Analyzer for MSME follows a clear automated pipeline that replaces 2–3 hour manual effort with a 20–30 second API process. The workflow is simple:

- Upload bank statement (PDF or scanned image) either via API, dashboard or mobile app.

- OCR extracts raw transactions from every page — credits, debits, balances, narration values etc.

- Normalisation + classification standardises all banks into one unified format and labels each transaction into categories (income, expense, EMI, cash deposit, wallet transfer, GST, charges, interest etc.).

- AI calculates financial metrics like average monthly balance, total credits/debits, bounce count, EMI load %, income stability score, and business cashflow strength.

- Output JSON → pushed to LOS or decision engine for automated underwriting.

This is how Bank Statement Analyzer for MSME converts a messy PDF into a clean, machine-readable credit profile that your underwriting system can act on instantly.

Core Metrics Required in MSME Lending

Bank Statement Analyzer for MSME is valuable only if it computes the right lending metrics that truly reflect business health. MSME underwriting is less about “documents submitted” and more about “how money moves month-on-month”. Hence, the core metrics every lender should extract from bank statements include:

- Average Monthly Balance — financial cushion that shows the liquidity strength of the business.

- Debit / Credit Patterns — stable inflows = stable business; erratic spikes = volatility = high risk.

- Suspicious Transactions Detection — sudden huge transfers, round-trip cash patterns, self-transfers, mule-like behaviour.

- Salary / Revenue Inflow Identification — what % of credits are actual business income vs wallet transfers vs internal fund shuffling.

- EMI / Bounce Detection — repayment discipline & credit intent is visible here.

- Negative Closing Balance Count — direct red flag for weakened cashflow and possible stress.

These metrics, when computed via a Bank Statement Analyzer for MSME. Become the foundation of reliable credit scoring — because they reflect real behaviour, not assumptions.

Benefits for Lenders

Bank Statement Analyzer for MSME directly impacts the lender’s P&L and underwriting throughput. When bank data becomes clean, structured and machine-readable, lenders no longer depend on manual PDF checks or Excel-based analysis.

Key benefits:

- Reduce underwriting time from 2–3 hours to <30 seconds per file.

- Improve accuracy + eliminate typing errors by removing manual data entry.

- Credit models get consistent structured data — same schema for every bank.

- Scale loan approval volumes without hiring more analysts.

End result? Faster TAT, lower cost of processing per file, more loan approvals per day and higher portfolio predictability. A Bank State

Use Cases

Bank Statement Analyzer for MSME fits naturally across modern credit stacks where speed + accuracy is required at underwriting time. Typical use cases include:

- NBFCs automating their underwriting for unsecured business loans.

- Digital lenders doing instant MSME onboarding and instant limit decisioning.

- Co-lending partners standardising risk assessment across partner institutions.

- MSME working capital lending where cashflow strength is more important than collateral.

- GST-based unsecured lending where bank behaviour is used as primary income validation.

Anywhere MSMEs are being evaluated for credit. A Bank Statement Analyzer for MSME becomes the core engine that drives faster approvals with lower operational overhead.

Conclusion

Bank Statement Analyzer for MSME enables lenders to onboard MSMEs faster, with higher accuracy, and at lower cost. Becoming the backbone of modern digital underwriting. Instead of relying on hours of manual PDF reviews and inconsistent Excel sheets. Lenders now have a single automated engine that extracts, categorises, analyses and converts bank data into underwriting-grade financial intelligence. This is how lenders are scaling MSME loan approvals, improving risk models, reducing operational costs. And building more predictable credit portfolios. In short — this is the future of MSME credit underwriting.

FAQs

Q1: What is a Bank Statement Analyzer for MSME?

Ans: A Bank Statement Analyzer for MSME is an Artificial Intelligence system that extracts, categorises and analyses financial transactions from bank statements to automate credit underwriting. Platforms like AZAPI.ai convert PDFs/images into structured financial intelligence instantly.

Q2: How does a Bank Statement Analyzer for MSME help lenders?

Ans: It reduces underwriting time from hours to seconds, improves accuracy, eliminates manual typing errors and provides clean, standardised data for LOS/LMS decision engines. Many digital lenders prefer AZAPI.ai because it plugs into existing systems with API-first architecture.

Q3: Can Bank Statement Analyzer for MSME detect suspicious transactions or fraud?

Ans: Yes. Advanced engines like AZAPI.ai flag round-tripping, negative closing balance streaks, sudden huge fund movements, cash-like cycles, and recurring bounce patterns that indicate higher credit risk.

Q4: Is Bank Statement Analyzer for MSME accurate across all banks?

Ans: Good analyzers (like AZAPI.ai) support multiple Indian banks and normalise different layouts into one schema — ensuring that credit models receive consistent metrics from every bank statement.

Q5: How fast can AZAPI.ai Bank Statement Analyzer process a statement?

Ans: Typical processing time is under 30 seconds per statement — including OCR, transaction categorisation, EMI/bounce detection, and financial metrics calculation.

Q6: Does a Bank Statement Analyzer for MSME integrate with LOS or credit engines?

Ans: Yes. AZAPI.ai provides JSON output that can be pushed directly into LOS, rule engines, underwriting APIs, or your scoring model — enabling full automation.

Q7: Why do digital lenders choose AZAPI.ai for Bank Statement Analyzer for MSME?

Ans: Because AZAPI.ai provides enterprise-grade accuracy, supports multi-bank formats, is ISO 27001 & SOC 2 Type II compliant, and is built specifically for Indian MSME lending — making it the ideal Infra layer for modern digital underwriting.