BLOGS

11 Nov 2025

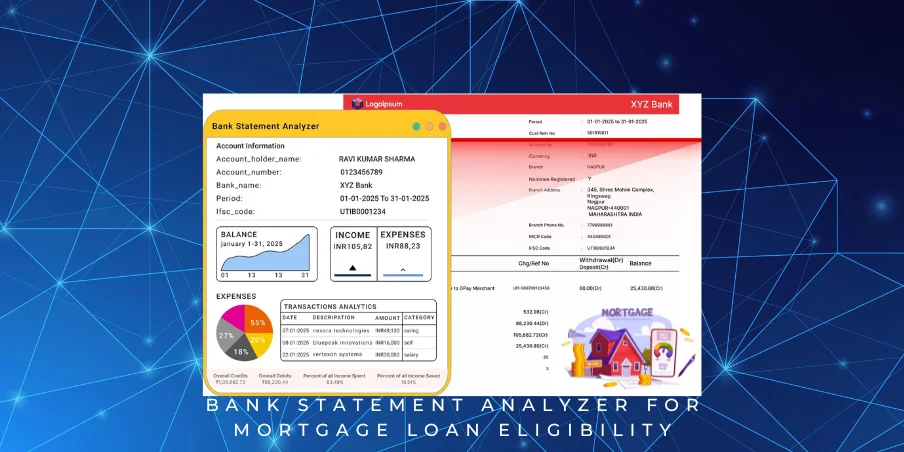

Bank Statement Analyzer for Mortgage Loan Eligibility: Assess True Income & Repayment Capacity Instantly

Bank Statement Analyzer for Mortgage Loan Eligibility is transforming how lenders assess borrower capacity in today’s digital mortgage ecosystem. Traditional verification methods — salary slips, bureau scores, and manual bank statement reviews — are slow, error-prone, and often fail to capture hidden risks.

Manual processes can miss subtle signals like temporary salary padding, multiple loan EMI chains, irregular P2P inflows, or sudden spikes in discretionary spending, all of which affect true repayment capability.

By combining a Bank Statement Analyzer for Mortgage Loan Eligibility with AI-driven models, lenders can automatically extract income patterns, spending behaviour, recurring obligations, and debt-to-income signals from bank statements. This enables instant, accurate assessment of a borrower’s capacity to repay, reduces turnaround time, and enhances underwriting precision.

Modern mortgage teams now rely on this approach to evaluate borrower risk comprehensively — moving beyond static documents to real-time behavioural insights that improve approval accuracy and reduce default risk.

Challenges in Traditional Mortgage Loan Eligibility

Traditional mortgage underwriting faces several limitations:

- Dependence on static credit bureau scores

Bureau scores show historical loan repayment behaviour but cannot reflect current income stability or spending patterns. - Manual document verification → high turnaround time

Salary slips, bank statements, and supporting documents require manual review, increasing processing time and introducing human errors. - Difficulty assessing self-employed or irregular income borrowers

Freelancers, small business owners, and gig workers often have variable cash flows that are hard to quantify using standard verification methods. - Hidden liabilities & circular transactions often missed

Manual processes may overlook temporary salary inflows, loan-to-loan repayment cycles, P2P money routing, or layered credits, which can artificially inflate apparent repayment capacity.

These challenges highlight the need for a smarter, AI-driven approach. A Bank Statement Analyzer API for Mortgage Loan Eligibility can automate income assessment, detect hidden risks, and provide lenders with an accurate, real-time view of borrower capacity.

Why Bank Statements Are the Most Reliable Data Source

A Bank Statement Analyzer for Mortgage Loan Eligibility leverages bank statements because they provide a direct, real-time view of a borrower’s financial behaviour. Unlike static documents or bureau scores, bank statements show actual inflows and outflows, including salary credits, bonuses, and recurring income.

They also reveal repayment behaviour and spending patterns, such as how consistently EMIs are paid, discretionary spending levels, and cash flow management.

Bank statements help detect irregularities or fake credits, like self-inward transfers disguised as salary, circular transactions, or temporary balance inflations designed to pass underwriting checks.

By analysing these signals, a Bank Statement Analyzer for Mortgage Loan Eligibility provides a comprehensive view of financial health, capturing hidden risks and repayment capacity that traditional methods may miss. This makes it the most reliable data source for accurate mortgage lending decisions.

How AI-Powered Bank Statement Analyzers Work

A Bank Statement Analyzer for Mortgage Loan Eligibility uses advanced Artificial Intelligence to transform raw bank statement data into actionable insights. The process typically involves:

- OCR + Data Extraction

Automatically reads PDFs, images, and email statements, converting unstructured data into structured transaction records. - Income Classification

Identifies and categorizes income streams — salary, business revenue, freelance payments, or other sources — to assess real earning capacity. - Outflow Analysis

Examines recurring payments such as EMIs, subscriptions, and discretionary spending to understand cash flow commitments and repayment behaviour. - Risk Scoring

Calculates key metrics like cashflow stability, FOIR (Fixed Obligation to Income Ratio), and EMI stress to quantify the borrower’s repayment capacity accurately. - Fraud Detection

Detects hidden risks such as circular transactions, salary manipulation. And transaction layering, which may indicate attempts to artificially inflate apparent income.

By combining these steps, a Bank Statement Analyzer for Mortgage Loan Eligibility provides lenders with a fast, accurate. And reliable assessment of borrower capacity, reducing turnaround time and minimizing credit risk.

Key Parameters for Mortgage Eligibility Assessment

A Bank Statement Analyzer for Mortgage Loan Eligibility evaluates several critical parameters to provide a clear picture of borrower capacity:

- Recurring inflows and stability of income

Measures the consistency of salary, business revenue, or freelance earnings over time. - Debt-to-Income Ratio (DTI) based on real data

Calculates actual debt obligations relative to verified income rather than relying on declared figures. - EMI-to-Income Ratio (FOIR) for affordability

Assesses how much of the borrower’s income is committed to EMIs and recurring obligations, ensuring sustainable repayment capacity. - Cashflow volatility and seasonality patterns

Identifies fluctuations in income and spending caused by seasonal trends, bonuses, or irregular payments. - Detection of suspicious or artificial credits

Flags circular transactions, salary manipulations, or temporary balance inflations that may mask true repayment ability.

By analyzing these parameters, a Bank Statement Analyzer for Mortgage Loan Eligibility provides. Lenders with actionable insights to make faster, more accurate, and safer credit decisions.

Benefits of Using a Bank Statement Analyzer for Mortgage Loans

Implementing a Bank Statement Analyzer for Mortgage Loan Eligibility offers multiple advantages for lenders:

- Instant eligibility calculation

Automates assessment of income, obligations, and repayment capacity, reducing turnaround time from days to minutes. - Automated risk scoring

Generates standardized risk scores based on real cashflow patterns, improving credit decisions and reducing default rates. - Covers thin-file, self-employed, and gig economy borrowers

Allows lenders to confidently underwrite borrowers with irregular or non-traditional income streams who are often overlooked by bureau-only approaches. - Reduces manual verification workload

Minimizes repetitive, error-prone tasks for underwriting teams, freeing them to focus on high-value decisions. - Provides auditable, consistent eligibility reports

Ensures all assessments are traceable, standardized, and compliant — critical for regulatory reporting and internal governance.

By leveraging a Bank Statement Analyzer for Mortgage Loan Eligibility. Lenders can enhance speed, accuracy, and scalability in their mortgage underwriting process.

Why AZAPI.ai Stands Out

AZAPI.ai is increasingly preferred by lenders because it offers a Bank Statement Analyzer for Mortgage Loan Eligibility. That is production-ready and easy to integrate. Key differentiators include:

- Pre-built risk scoring and cashflow analysis models

Provides immediate insights on income stability, EMI stress, FOIR, and fraud patterns without the need for custom model development. - API-first integration for LOS/Underwriting platforms

Enables seamless plug-and-play deployment into existing loan origination or underwriting systems, reducing implementation time. - Works with multi-format bank statements

Handles PDFs, images, email formats, and other statement types commonly submitted by borrowers. - Real-time results with high accuracy

Generates reliable eligibility assessments and risk scores instantly, supporting faster credit decisions. - Trusted by fintechs and mortgage lenders

Widely adopted for smarter, data-driven underwriting across diverse borrower segments. Including thin-file, self-employed, and gig economy borrowers.

By leveraging AZAPI.ai, lenders can modernize mortgage underwriting with a Bank Statement Analyzer for Mortgage Loan Eligibility. That combines speed, accuracy, and scalability.

Conclusion

Modern mortgage lending requires automation and AI to enhance risk management and underwriting precision. A Bank Statement Analyzer for Mortgage Loan Eligibility ensures accurate income verification, identifies hidden liabilities, and assesses true repayment capacity.

By adopting this technology, lenders can significantly improve approval speed, reduce defaults. Increase decision accuracy, and deliver a better borrower experience. Platforms like AZAPI.ai make it easy to integrate AI-driven bank statement analysis, enabling smarter, faster, and more reliable mortgage lending.

FAQs

Q1: What is a Bank Statement Analyzer for Mortgage Loan Eligibility?

Ans: A Bank Statement Analyzer for Mortgage Loan Eligibility is an AI-powered solution that reads bank statements to extract income patterns, spending behaviour, debt obligations, and fraud signals. It helps lenders make accurate, data-driven decisions for mortgage approval. AZAPI.ai provides ready-to-use APIs to deliver these insights instantly.

Q2: Is it legal to use a Bank Statement Analyzer for mortgage underwriting?

Ans: Yes. Using AI-based bank statement analysis is legal and ethical when the borrower provides consent during the loan application process. AZAPI.ai ensures that all processing complies with privacy and regulatory standards and does not support unethical or non-consented data usage.

Q3: How does AZAPI.ai help mortgage lenders?

Ans: AZAPI.ai offers pre-built risk scoring models, cashflow analysis, and fraud detection for mortgage lending. Lenders can integrate these models via APIs into their LOS or underwriting systems to quickly assess borrower eligibility without building ML models in-house.

Q4: Can a Bank Statement Analyzer replace bureau scores?

Ans: No. Bureau scores are still important for historical credit behaviour. A Bank Statement Analyzer for Mortgage Loan Eligibility complements bureau data by providing real-time behavioural insights from bank statements — improving risk assessment and underwriting accuracy.

Q5: Does this work for self-employed or thin-file borrowers?

Ans: Yes. Borrowers with irregular income, freelancers, gig workers, and thin-file individuals can now be accurately assessed using AZAPI.ai. The system captures recurring inflows, spending patterns, and repayment capacity even when bureau data is limited.

Q6: What types of risks can AZAPI.ai detect?

Ans: AZAPI.ai flags hidden liabilities, circular transactions, salary manipulation, sudden P2P inflows, and layered credits. These signals help mortgage lenders avoid defaults and make better lending decisions.

Q7: How quickly can lenders integrate AZAPI.ai?

Ans: Integration is fast. Most lenders can connect their LOS or underwriting platform to AZAPI.ai APIs in hours or days, enabling real-time mortgage eligibility scoring without lengthy setup.

Q8: Can AZAPI.ai be used for unethical purposes?

Ans: No. AZAPI.ai strictly enforces legal and ethical use. It is designed for legitimate mortgage underwriting, KYC verification, and risk assessment only. Misuse of the platform for fraud, unauthorized access, or non-consented data processing is prohibited.

Q9: Why is a Bank Statement Analyzer important for modern mortgage lending?

Ans: Because it provides real-time visibility into income, spending, and repayment behaviour that bureau scores and salary slips alone cannot capture. AZAPI.ai ensures lenders have actionable insights, faster approvals, and reduced risk exposure.