BLOGS

06 Aug 2025

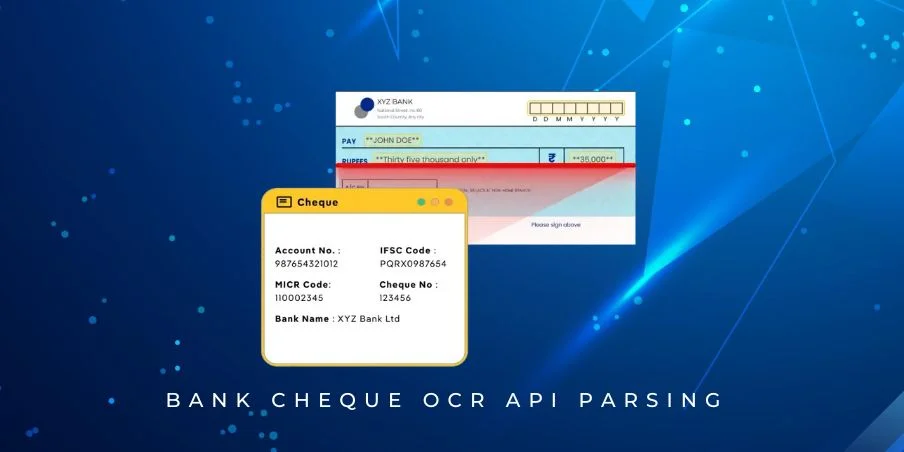

Bank Cheque OCR API Parsing for Smart Banking Automation

The Cheque Isn’t Dead — It’s Just Evolving

Trends: Why cheques still matter in India, the Middle East, and parts of Europe

Bank Cheque OCR API Parsing has become increasingly relevant in today’s financial landscape, not because cheques are obsolete, but because they’re evolving. Despite the global push toward digital payments, cheques continue to play a vital role in several economies — especially in regions like India, the Middle East, and parts of Europe. While card-based and app-based transactions dominate headlines, the reality is that many businesses and individuals still rely on cheques for high-value transactions, B2B payments, and formal record-keeping.

In India, for instance, data from the Reserve Bank of India (RBI) shows that although digital payments have skyrocketed — with UPI alone accounting for over 60 billion transactions in FY24 — cheque volumes still exceed 1 billion annually. These are primarily used in corporate payments, rent agreements, and legal settlements. Similarly, in the UAE and Saudi Arabia, post-dated cheques are a cornerstone of lease and credit agreements. This reliance on cheques creates an ongoing demand for tools that can digitize and verify them efficiently.

That’s where Bank Cheque OCR API Parsing technology becomes indispensable.

Financial institutions, fintech platforms, and accounting software providers are increasingly integrating such APIs to streamline cheque processing, reduce fraud, and improve reconciliation times. The APIs use Optical Character Recognition (OCR) to extract data like payer details, cheque amount, date, and MICR codes from scanned cheque images — allowing for automation that was previously only possible for fully digital payments.

In parts of Europe like France, Portugal, and Italy, cheques remain culturally and legally embedded in the payment ecosystem. While digital banking is widespread, legacy systems and traditional preferences mean that cheques aren’t going away anytime soon. In fact, many banks are modernizing their back-office operations by incorporating Bank Cheque OCR API Parsing to improve cheque clearing workflows and enhance customer service.

Moreover, cheque fraud — which remains a significant concern — can be addressed using intelligent OCR systems that flag inconsistencies in handwriting, signature mismatches, or altered values. This preventive capability further reinforces why OCR-based cheque parsing is no longer optional but essential in cheque-reliant regions.

In conclusion, cheques are not relics of the past; they’re part of a hybrid future. As long as they remain in circulation, so will the need for scalable, accurate, and secure Bank Cheque OCR API Parsing solutions.

The Real Problem Isn’t Slowness — It’s Data Isolation

Most banks and financial institutions do scan cheques — but primarily for compliance and archival purposes. These scanned images are often treated as static records, locked away in back-office systems. No real data extraction occurs. As a result, valuable transactional insights remain trapped in image form, isolated from the bank’s core data workflows.

This is where Bank Cheque OCR API Parsing changes the game. It doesn’t just scan — it extracts. By converting cheque images into structured, machine-readable formats, OCR parsing transforms a dead scan into live, queryable data. Account numbers, IFSC codes, amounts, dates, and signatures become accessible fields that can be searched, verified, and integrated into downstream systems.

In essence, you’re not just digitizing a document — you’re unlocking the data within it.

Cheque OCR as a Gateway to Predictive Finance

Bank Cheque OCR API Parsing isn’t just about digitizing transactions — it’s a foundational step toward predictive finance.

By extracting structured data from cheque images, businesses can feed cheque payment trends into analytics pipelines. For example, identifying high-volume payers, frequent vendors, or monthly patterns helps build robust forecasting models. This is especially useful in sectors where cheque payments still dominate, such as manufacturing, construction, and real estate.

For small and mid-sized businesses (SMBs), cheque metadata — like issue dates, clearance times, and payer frequency — becomes a rich source of cashflow intelligence. With OCR-parsed data, financial platforms can predict liquidity gaps, optimize payment cycles, and even trigger alerts for delayed cheque settlements.

In short, Bank Cheque OCR API Parsing turns static documents into dynamic signals for smarter financial planning.

Anatomy of a Smart Cheque Parsing API

Bank Cheque OCR API Parsing today goes far beyond simple text recognition. A truly smart API doesn’t just read — it understands.

Beyond Text: Modern APIs are trained to detect layout anomalies, such as shifted fields, tampered MICR lines, or altered amounts. They can flag missing signature blocks, irregular stamp placements, and even detect handwritten overrides that don’t match the original issue patterns. This elevates cheque scanning from passive record-keeping to active quality control.

Beyond Extraction: Advanced parsing APIs integrate fraud detection capabilities — spotting inconsistencies in fonts, date alterations, and duplicate cheque numbers. With inbuilt threshold alerts, banks and fintechs can define custom rules (e.g., alert if cheque value exceeds ₹5,00,000 or if the payer has a flagged account) to enable real-time decision-making.

Microservices-Friendly Architecture: A well-designed Bank Cheque OCR API Parsing system supports modular chaining:

parse → validate → approve

Each step can be handled by dedicated microservices, making the system scalable, maintainable, and easy to integrate with existing KYC, risk, and compliance modules.

Fintech Innovation: Cheques as APIs

In a world obsessed with real-time payments, it may sound counterintuitive — but cheques are getting a fintech makeover. Enter “Cheque as a Service”, where fintechs are embedding Bank Cheque OCR API Parsing into white-labeled platforms, turning traditional cheque workflows into seamless, API-driven services.

Imagine this: a user remotely submits a cheque using their smartphone camera → the image is instantly parsed → data is verified → the payment is posted. No branch visits, no manual entry, no waiting. This is not theoretical — it’s already in production across neobanks, B2B platforms, and accounting tools catering to markets where cheques are still common.

Another growing use case? Batch scanning for enterprise vendors who still issue cheques en masse. By integrating OCR APIs, platforms can digitize and process dozens — or hundreds — of cheques in a single batch, syncing directly with accounting or ERP systems.

Bank Cheque OCR API Parsing enables fintechs to turn a legacy payment method into a fully digital, auditable, and programmable experience — breathing new life into old money.

Security Isn’t a Feature — It’s the Product

When it comes to financial documents like cheques, security isn’t a value-add — it’s the foundation. That’s why leading Bank Cheque OCR API Parsing solutions are built with banking-grade encryption, field-level data masking, and comprehensive access logging at the API layer.

Every interaction with a cheque image — from upload to parsing — is encrypted in transit and at rest. Sensitive fields like account numbers or payer names can be masked dynamically based on role-based access controls, ensuring only authorized systems or users can view them.

Example: A bank’s fraud team may need to log and analyze MICR codes for auditing, but not see full account numbers. With field-level controls, the API can redact account numbers in output responses while preserving the MICR data — maintaining both compliance and operational efficiency.

Access logs capture every request, timestamp, IP address, and user action, offering full audit trails to meet regulatory standards like PCI DSS, SOC 2, or RBI guidelines.

In short, smart Bank Cheque OCR API Parsing solutions treat security not as an afterthought — but as the product itself.

Developer First: Why Modern OCR APIs Are a Joy to Integrate

Legacy cheque processing systems were built for operations teams. Modern Bank Cheque OCR API Parsing platforms? They’re built for developers.

With an emphasis on DX (Developer Experience), today’s APIs offer a single, unified endpoint, return clean, structured JSON responses, and support sandbox keys for quick prototyping. No bloated XML payloads, no outdated protocols — just straightforward, RESTful design.

SDKs are available in popular languages (Python, JavaScript, Java, etc.), with support for features like:

- Live testing using dummy cheque images

- Webhook support for asynchronous parsing and validation

- Clear error messages and debug logs

- Field-level confidence scores to help handle edge cases

This means a developer can go from concept to working integration in hours, not days.

By lowering the integration barrier. Bank Cheque OCR API Parsing becomes not just a backend service — but a plug-and-play component of modern fintech infrastructure.

What’s Next: Cross-Language & Cross-Border Cheque Parsing

As cheque usage persists across diverse geographies. The future of Bank Cheque OCR API Parsing lies in its ability to go global — and multilingual.

Developers are training next-gen OCR engines to handle multilingual cheques by parsing. Handwritten or printed text in regional languages like Hindi, Arabic, Bengali, and Tamil. Along with global standards like English and French. This capability is crucial in markets like India or the UAE, where bilingual cheque formats are common.

But language is just one dimension.

Cross-border transactions often involve different cheque formats, each with its own layout conventions, field placements, and regulatory requirements. For example:

- US cheques emphasize ABA routing numbers and signature zones.

- EU cheques often follow SEPA compatibility and use IBANs.

- Indian cheques follow RBI guidelines with MICR and CTS-2010 standards.

Modern APIs are evolving to automatically detect and adapt to these regional formats. Enabling global fintech platforms to offer truly borderless cheque processing.

In short, the future of Bank Cheque OCR API Parsing is not just smarter. It’s more inclusive, more adaptable, and ready for the complexities of global finance.

Conclusion: Cheque Parsing Is Not a Dead-End Tool — It’s a Trojan Horse for Legacy Modernization

Far from being obsolete, Bank Cheque OCR API Parsing is emerging as a quiet disruptor. A Trojan Horse for legacy modernization.

With a single, developer-friendly API, banks and fintechs can breathe new life into outdated cheque workflows. What starts as a simple data extraction layer quickly unlocks a cascade of benefits. Structured data streams, fraud detection, predictive analytics, faster settlements, and richer customer experiences.

Rather than replacing legacy cheque systems overnight, parsing APIs integrate with them. Augmenting what exists, while paving the way for future-ready infrastructure. The result? Lower operational overhead, higher security, real-time insights, and greater financial inclusivity for regions and users who still rely on cheques.

In short, Bank Cheque OCR API Parsing isn’t just about reading paper — it’s about rewriting what’s possible.

FAQs

1. What is Bank Cheque OCR API Parsing?

Ans: Bank Cheque OCR API Parsing refers to the process of extracting structured data from cheque images using Optical Character Recognition (OCR). It allows banks and fintechs to convert scanned cheque images into usable digital data.

2. How does a Bank Cheque OCR API work?

Ans: A Bank Cheque OCR API accepts a scanned cheque image and returns extracted information like account number, IFSC code, amount, date, and MICR code in JSON format. It can also detect anomalies, handwritten overrides, and missing fields.

3. Why should I use a Bank Cheque OCR Service?

Ans: A Bank Cheque OCR Service helps automate manual data entry, reduce fraud, speed up cheque processing, and unlock valuable financial data for analytics. It’s ideal for banks, NBFCs, fintechs, and accounting software platforms.

4. Can the Bank Cheque OCR API handle handwritten text?

Ans: Yes, modern Bank Cheque OCR APIs are trained to parse both printed and handwritten fields, such as payee name or written amounts, depending on image quality and language model.

5. Is Bank Cheque OCR API Parsing secure?

Ans: Absolutely. Bank Cheque OCR API Parsing services use banking-grade encryption, field-level masking, and detailed access logging to ensure secure handling of sensitive data.

6. Can the Bank Cheque OCR Service support regional languages?

Ans: Yes, advanced Bank Cheque OCR services support multilingual parsing, including Hindi, Arabic, and other regional languages, depending on configuration.

7. What is needed to integrate the Bank Cheque OCR API?

Ans: All you need is access to the Bank Cheque OCR API endpoint, sandbox keys for testing, and your cheque images. Integration is quick with clean JSON responses and SDKs for popular programming languages.

8. Can I test the Bank Cheque OCR API before going live?

Ans: Yes, you can use dummy cheque images in sandbox mode to test the Bank Cheque OCR API and simulate real-time parsing, validation, and response handling.

9. Does the Bank Cheque OCR API support bulk or batch cheque processing?

Ans: Yes, many Bank Cheque OCR Services offer batch processing capabilities to handle multiple cheques at once — ideal for vendors or enterprises receiving large volumes.

10. What kind of data can I extract using Bank Cheque OCR API Parsing?

Ans: You can extract payer name, account number, IFSC code, amount (both numeric and written), cheque number, MICR code, date, signature presence, and more using Bank Cheque OCR API Parsing.

11. Can I get fraud detection features with the Bank Cheque OCR API?

Ans: Yes, advanced Bank Cheque OCR APIs come with built-in fraud detection, such as identifying tampered fields, layout shifts, duplicate cheques, and suspicious entries.

12. Who can benefit from a Bank Cheque OCR Service?

Ans: Banks, fintechs, credit unions, NBFCs, ERP vendors, and even small businesses can benefit from using a Bank Cheque OCR Service to digitize and automate cheque workflows.

13. Is the Bank Cheque OCR API compliant with banking regulations?

Ans: Most reputable Bank Cheque OCR APIs are built to comply with regional financial regulations (e.g., RBI in India, PCI DSS, SOC 2), offering logging and audit features to support compliance.

14. What’s the difference between Bank Cheque OCR and Bank Cheque OCR API?

Ans: Bank Cheque OCR refers to the core technology that reads cheque data. Bank Cheque OCR API is the interface that allows developers to access that technology programmatically in their applications.

15. How does Bank Cheque OCR API Parsing improve customer experience?

Ans: By reducing cheque processing times, minimizing errors, and enabling remote cheque deposits, Bank Cheque OCR API Parsing delivers a faster and smoother experience for end users.